Direct-to-consumer (DTC) brands have long been at the front of innovation in the crowded ecommerce field as disruptors going head-to-head with established retailers. But a lot has changed in the last few years: new privacy regulations are decreasing the effectiveness of the targeted advertising many DTC brands rely on, established brands are investing heavily in DTC strategies, and, after the stratospheric highs of the pandemic, ecommerce itself has lost some of its forward momentum.

Many DTC brands are struggling, and the pressure is on for companies to find ways to adapt to the new ecommerce climate.

That’s especially true for digitally native vertical brands (DNVBs). When these companies first came on the scene, they shook up the world of online retail, giving customers the option to buy their glasses, shaving products, or even their next car directly from slickly-branded digital stores.

But established brands learned from the disruptors and are now beating them at their own game: according to eMarketer, established brands will account for almost 80% of DTC ecommerce sales in 2023. DNVBs like Carvana, Warby Parker, and Allbirds have recently laid off staff after significant losses.

To get the edge back and re-capture market share, DTC brands, especially DNVBs, need to make significant strategy adjustments. Luckily, 2023’s rapidly evolving digital marketing world presents a lot of new opportunities these brands can capitalize on—if they’re ready to take some risks and prove again that they are the true masters of ecommerce innovation.

Forging new paths to DTC ecommerce success on social

DTC brands have traditionally relied on targeted digital advertising for customer acquisition, but new privacy changes like Apple’sAppTrackingTransparency (ATT) have thrown a wrench in the works, making targeting more difficult and search and social ads (the bread and butter of DTC digital strategy) less effective.

But the smartest DTC companies aren’t looking backward; they’re finding new ways to reach audiences and drive conversions by leveraging first-party data and/or diversifying the media mix by looking to new advertising channels.

Social media is still an essential avenue for DTC brands, but Facebook and Instagram are no longer the only players in town. TikTok has done exactly what the DNVBs did in the past: offered an alternative platform that appealed directly to consumers and has now made significant inroads and challenged Meta’s dominance with advertisers. In the process, the little video platform that could created one of the fastest-growing marketing opportunities on the planet.

What TikTok doesn’t have are the advanced advertising capabilities of its more established Meta counterparts. But it brings a lot of benefits that more than make up for those challenges, in particular, ultra-high levels of engagement and new ways for brands to connect with audiences they can’t reach elsewhere. And many established brands are still lagging behind on the platform, wary of TikTok’s creator-centric approach to creative and still-evolving ad offering.

DTCs have a real opportunity to outplay established brands: TikTok plays into their strengths as digital pioneers and risk-takers, community-builders, and customer-first leaders.

TikTok is also investing heavily in the up-and-coming arena of social commerce, which lets consumers shop directly within the social media platform and is already a major force in China. And it’s not the only one: Deloitte predicts that social commerce will top $1 trillion in global sales in 2023 and only continue to grow.

In addition to delivering a more seamless user experience, social commerce can also help brands collect first-party data, since customers are often more willing to share their data with brands in exchange for access to special experiences like live streams. That stockpile of owned data is a major competitive differentiator in a privacy-first world because it will be critical for accurate and effective targeting.

Beyond social, there are other new digital opportunities to consider, including the booming over-the-top (OTT) TV market. The rise of streaming has significantly lowered existing barriers to entry when it comes to TV, opening the door to more flexible ad activations and access to more addressable audiences. DTC brands, especially those already investing in YouTube and other digital video opportunities, should lean into the opportunity to connect with new customers on the biggest screen in the house.

Pivoting DTC brands to third-party marketplaces and retail media networks

DTC brands became a force to be reckoned with by selling (you guessed it) directly to consumers. But the ecommerce landscape never holds still, and retail media is one of the most important channels for DTC brands today.

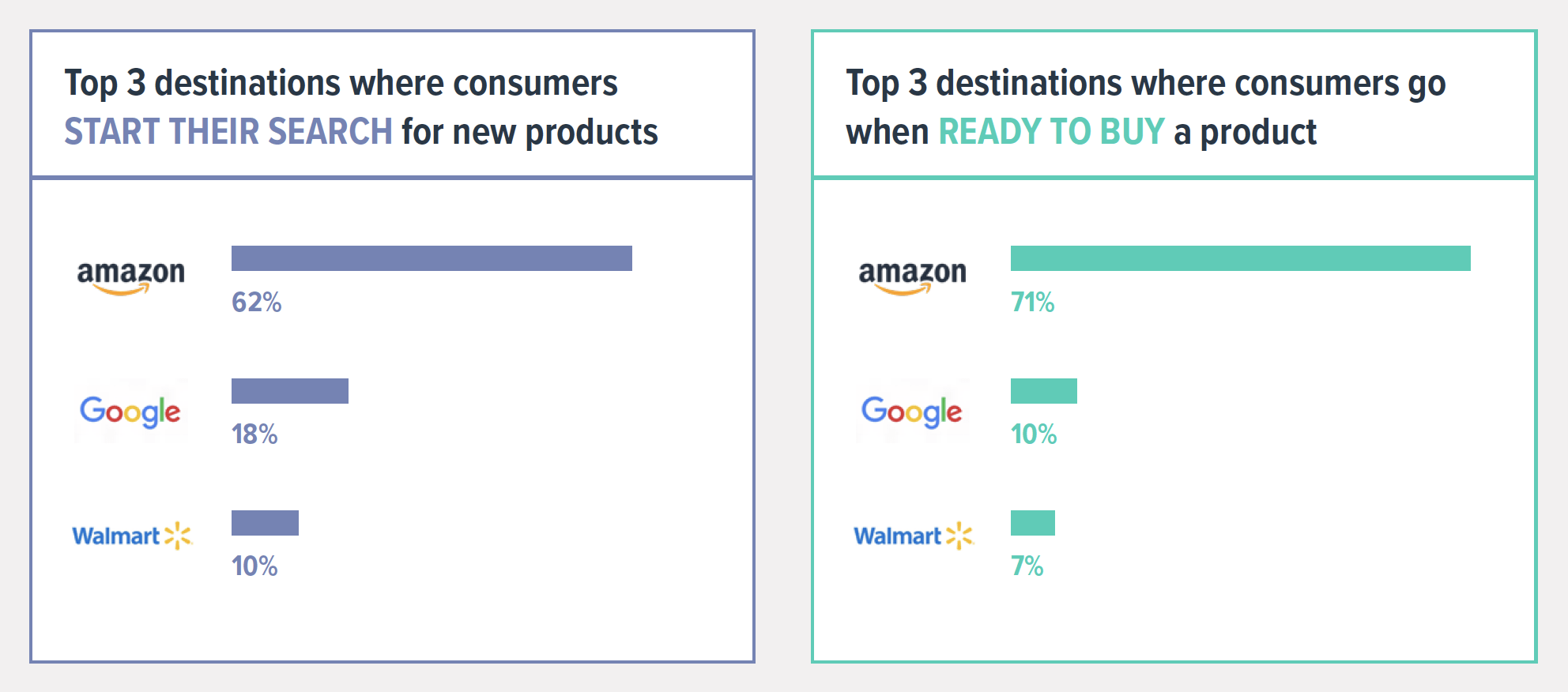

Partnering with larger retailers to sell products might seem counterintuitive; DNVBs in particular have been hesitant to give up their original premise of selling from their own websites. But the real fuel that powered DTCs was their ability to embrace new capabilities to better meet consumer needs. And consumers are going to Amazon, Target, and Walmart to discover new products, research, and purchase.

Some well-known DTC brands, like Peloton, have made the leap to Amazon. These retail media marketplaces offer some major benefits, first and foremost the ability to leverage their vast stores of first-party data to target ads both on the platforms and on the open web through demand-side platform (DSP) offerings that allow display, video, and CTV placements. They can also leverage familiar Amazon perks like one-click checkout on their sites.

Advertising on retail media networks (RMNs) is an increasingly important part of the media mix. In addition to easing some of the burden of data privacy-constrained digital ad targeting and attribution, retail media lets advertisers grab customer attention close to the point of sale.

Retail search is also a factor in these strategies. Amazon is now a go-to search engine for a lot of consumers looking for products, with fast-evolving RMNs like Walmart Connect and Roundel (Target) competing for search supremacy. You need to take a truly full-funnel approach to retail media to make the most of the opportunity.

Kicking DTC marketing offline to find new avenues for growth

Digital has long been the primary domain for DTCs, especially DNVBs, but the path to success this year might just mean going offline. Brick-and-mortar retail experiences and old-school advertising are smart options in a world where digital ads are getting more expensive.

DNVBs have taken different approaches to selling physical products. Some, like Vuori, Brooklinen, and Allbirds, now have owned-and-operated physical stores. For brands that can afford it, these stores can be a great way to increase brand awareness and sell products directly to their customers, live and in person. But high overhead costs make this option prohibitively expensive for most.

More brands have taken the more affordable route, selling wholesale in other retailers like Target and Walmart. You may have seen DNVBs like Harry’s and Quip appear in your local Target recently, and some brands are even tailoring offerings to in-store audiences like Adore Me did with their line in Walmart.

That opens up some interesting advertising opportunities for programmatic campaigns through retail media. Brick-and-mortar retailers like Target and Walmart offer physical ads that can hit in-store audiences almost as massive as Amazon’s online reach.

From front-of-store kiosks to digital shelving, physical retail media options are nearly endless, but brands need to be careful about how they deploy them. Shoppers don’t want to be confronted by over-the-top ads on their Target run, so displays need to fit naturally into the physical space and provide eye-catching visuals to grab their attention without turning them off.

Store displays aren’t the only retro advertising channel open to DTC brands, either. Billboards and other digital out-of-home (DOOH) ad options are now widely available, and can even be used to drive people toward specific retail locations. Many DTCs have also been experimenting with direct mail and catalogs as a way to reach people beyond the ubiquitous screen.

Finding the silver lining for DTC and digitally native brands

Despite some bleak forecasts for DTC brands, there are still plenty of opportunities for growth this year. Even though ecommerce sales have slumped from pandemic highs, Morgan Stanley projects that the ecommerce global market could grow from $3.3 trillion to $5.4 trillion by 2026.

That means you have the power to right the ship if your brand has been trending downward. That doesn’t mean it will be easy. But in today’s competitive market, brands have to be willing to change the playbook if they want to make it in a new ecommerce world.

Most DTCs started as underdogs. It’s time to take up that scrappy, innovative mindset once again. That’s what we mean when we say brands need to Think Like A Challenger.

Now is your opportunity to rise to the challenge.

Data is the lifeblood of DTC marketing strategy: learn how to adapt to new data privacy rules with our full guide, State of the Data 2023: The Path to Profitability Requires Privacy Compliance.