It’s the most wonderful–and stressful–time of the year for brands looking to meet their 2023 goals. Although Black Friday and Cyber Monday (BFCM) are usually major shopping days for American consumers, many marketers were wary about this year in the wake of continued economic uncertainty and changing consumer behavior.

But it looks like they had nothing to fear: according to Adobe Analytics, US customers spent a record $9.8 billion on Black Friday, up 7.5% YoY from October 2022.

As an early present for marketers, the forecast is looking sunny for the rest of the holiday season, too. Adobe predicts that U.S. online holiday sales will hit $221.8 billion this holiday shopping season, a 4.8% growth YoY.

Although the numbers look better than expected, brands will have to stay on their toes to win the remainder of Q4. We dug into our proprietary data to understand the trends that impacted Cyber Week 2023 and to answer the critical question: how can you squeeze the most out of the rest of the holiday season?

The big picture: Cyber Week is still a powerhouse, but the calendar is shifting

Let’s start by looking at the factors affecting consumer spending. Americans have more buying power than in recent years as inflation has continued to cool, down to 3.2% YoY in October according to the Bureau of Labor Statistics. They’re also seeing rising wages and a strong labor market—and are in a better place to spend this Q4 than they have been in years.

But some economic factors had marketers questioning the wisdom of investing heavily in BFCM: high interest rates, soaring prices for basic goods, and tightening access to credit were all front of mind going into the big week.

And then there was the shifting calendar to consider: for years, the holiday shopping season has crept forward into October and even September, lessening the impact of red-letter shopping days like Black Friday. It’s true: early spending continues to be a big factor in the evolution of holiday planning for brands.

But the National Retail Federation found that 72% of holiday shoppers planned to shop on Black Friday, up from 69% in 2022, driven by the desire to make the most of tight budgets by taking advantage of the big day’s famous discounts.

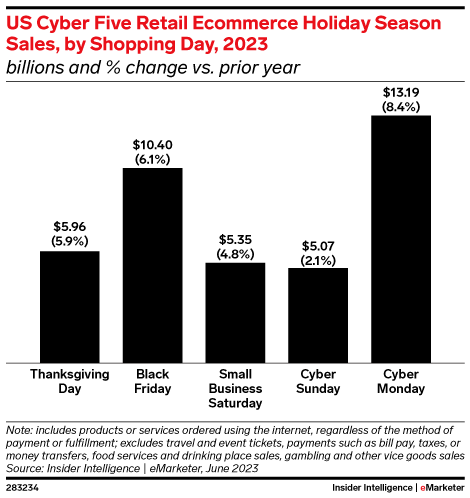

We’re calling it now: the Cyber Five is still a crucial part of Q4. And it’s going to stay that way for the foreseeable future.

According to Mastercard, ecommerce sales rose 8.5% YoY, handily outpacing eMarketer’s forecast of a 6.1% gain.

Black Friday 2023 deals drove higher ROAS, lower AOV

Black Friday itself may no longer be the day for shopping, but it’s inarguably still a big day for purchases. And the full slate of Cyber Week offers consumers even more opportunities to take advantage of promotions, sales, and deals.

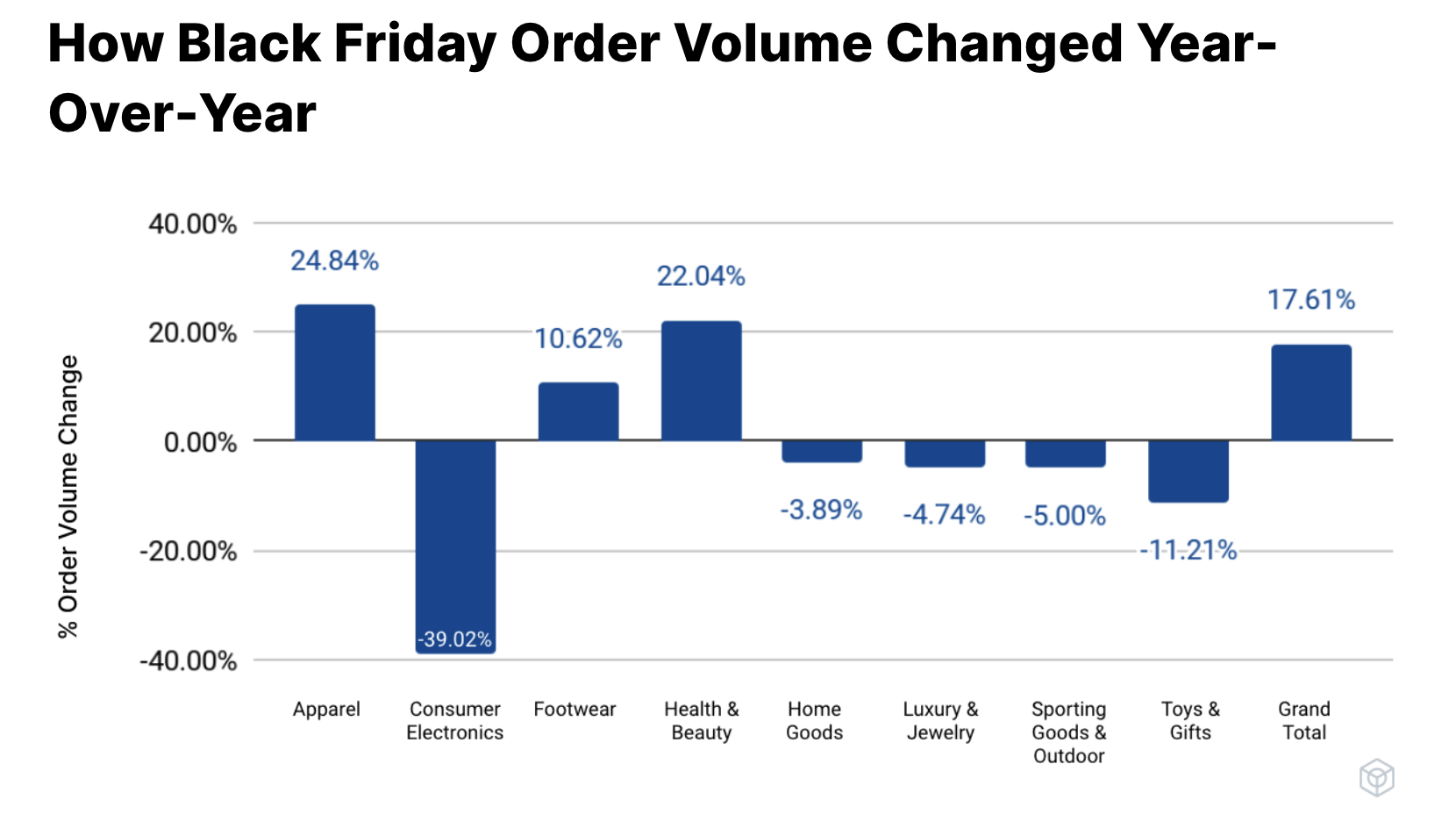

The focus on sales and deals did impact average order value (AOV). Overall, Bluecore found that number of orders across BFCM increased by 18%, while AOV decreased by 2%, at least partly due to significant discounting.

But lower AOV didn’t hamper return on ad spend (ROAS). On social, Wpromote clients saw an impressive 37% increase in ROAS YoY on Black Friday. In fact, social ROAS and conversion rate (CVR) were higher on the traditional big day than on Cyber Monday, proving that consumers are still showing up ready to spend the day after Thanksgiving.

Interestingly, in a nod to the changing holiday calendar, we found that November first drove the highest ROAS on social across the entire month, signaling the continued shift toward earlier shopping.

Retail media results, on the other hand, showed Cyber Monday ascendant, which charted 27% higher ROAS vs. Black Friday, as well as 26% lower CPCs.

The big picture data from Adobe Analytics indicated that Cyber Monday outpaced Black Friday when it came to sales, with consumers spending $12.4 billion on Cyber Monday this year, up 9.6% YoY. Our client revenue data backed that up across nearly every marketing channel… except for one outlier: paid search. At the search bar, Black Friday drove significantly more revenue than Cyber Monday.

Budget-savvy shoppers turned out for discounts and flexible spending options in 2023

We already knew that good deals would be a major driver during a financially difficult holiday season: 44% of US consumers planned to shop during the pre-holiday sales periods to take advantage of discounts, according to Mintel.

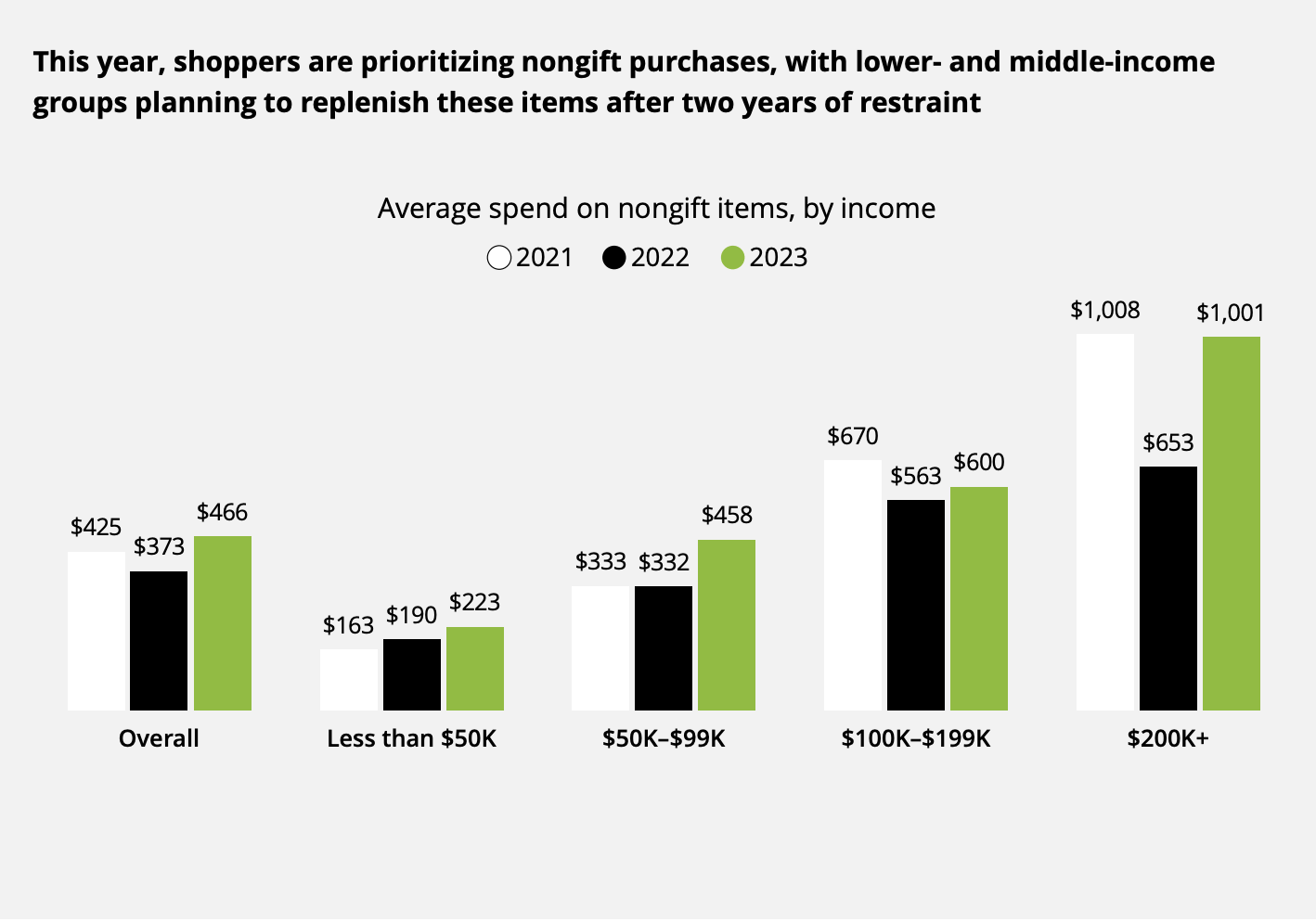

People were holding out for discounts: Google reported that consumers were looking to see at least 30% off before they started spending. Many shoppers also used Black Friday and Cyber Week deals to stock up on non-gift items they hadn’t bought during the last few years of tough financial times. Brands had a major opportunity to grab both holiday and non-holiday conversions if they were ready to go all in with discounts.

Our data confirmed that holiday offers were essential this year. People came for deals; if brands didn’t deliver, they spent their dollars elsewhere. Our paid search clients that ran holiday ads with no sales offers saw increased search volume but lower conversion rates.

Wpromote apparel clients offering higher discounts (up to 60% off) captured higher BFCM revenue YoY than those with lower discounts like 20% off.

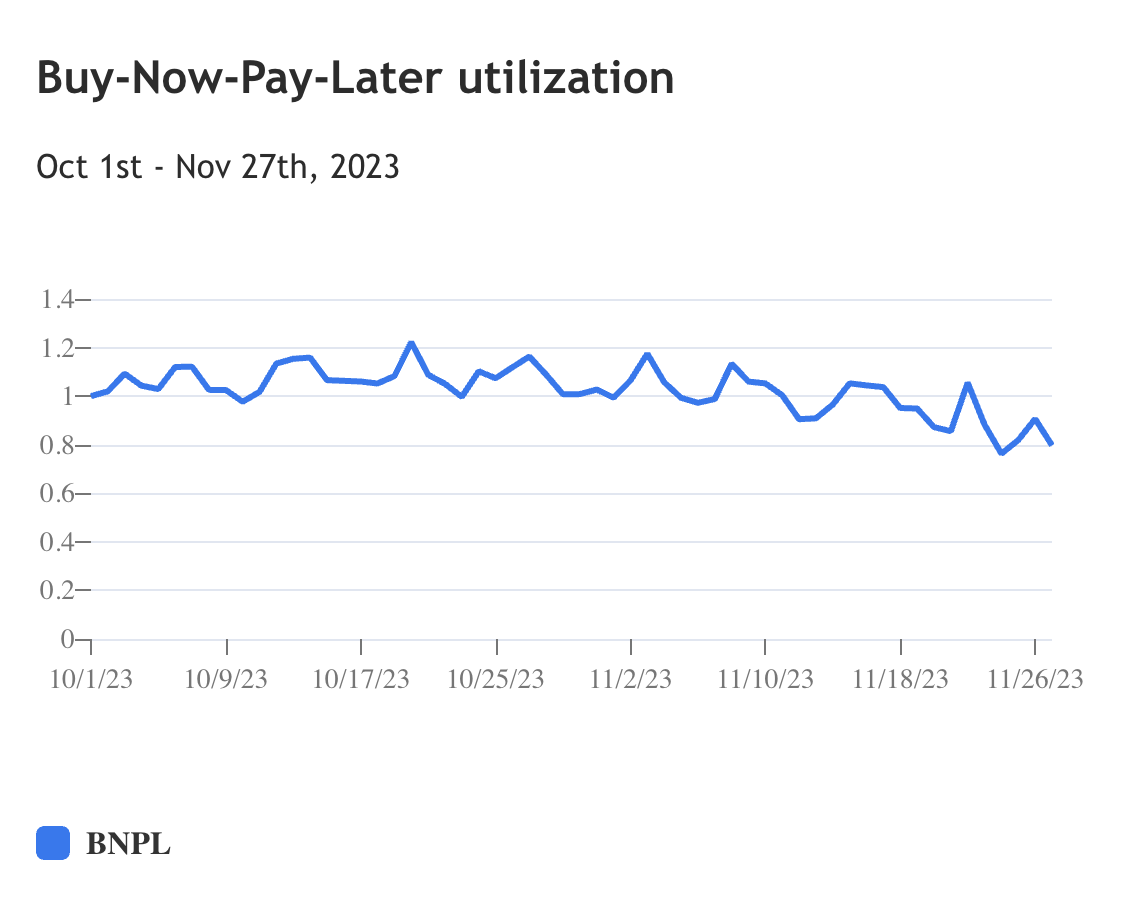

Beyond discounts, many shoppers turned to alternative payment methods to get more out of their budgets this holiday season. Adobe Analytics found that buy now, pay later (BNPL) options accounted for $940 million in online spending on Cyber Monday. This massive spike in BNPL spending, up 42.5% YoY, shows that flexible spending is a major consideration for consumers, and that’s likely to continue into 2024.

Factors like inflation and reinstated student loan payments have made BNPL an important feature for many customers looking to shop despite budget constraints. Brands looking to pull in price-conscious audiences should emphasize holiday discounts and BNPL offers to help customers make the leap to purchase.

Cutting-edge ad formats gain traction across channels

From 2023 to 2024, we saw brands diversify their campaign mix by leaning into new opportunities and ad formats like AI-powered Performance Max (PMax) on Google and Advantage+ shopping campaigns (ASC) on Meta, as well as full-funnel options through Amazon DSP on the retail media side.

PMax is currently positioned as the future of Google Ads (in tandem with the newer mid- and upper funnel Demand Gen campaigns), so it’s no surprise that PMax campaigns claimed 48% of all paid search traffic for our clients in Cyber Week. But they delivered on results, driving 53% more revenue YoY against 37% more spend. Our teams were able to implement various ad customizers to power seamless messaging transitions between Black Friday, Cyber Monday, and the rest of the peak period.

On the social side, early adoption of Meta ASC campaigns paid off; multiple clients saw ASC take the lead in terms of volume and revenue against other Meta campaign types. But they did not always prove to be the most efficient, so further testing around budget caps and daily budget flighting vs. lifetime ASC optimization will be necessary to deploy them as effectively as possible.

Amazon, of course, is expected to be a strong player during Cyber Week, but our clients actively invested in Amazon DSP got a bit of an early Christmas present. CPMs were significantly lower YoY, and over 58% of purchases driven from our clients’ DSP campaigns on both Black Friday and Cyber Monday were new-to-brand. DSP video campaigns in particular punched above their weight.

What these three campaign types have in common is preparation: all of them require sufficient investment and testing in advance of the peak shopping periods.

You can’t just turn new campaign types on in Q4 and expect to generate maximum results. As you pivot into 2024, remember to build in sufficient testing budget for testing well in advance of the holiday season.

What we can take from BFCM to finish the holiday season strong

As the holiday season winds down, you’ll be facing a lot of competition for those customers still shopping until the last minute. That means you need to put real thought into creating meaningful holiday offers. If your BFCM deals were a big hit with customers, consider extending those promotions to get more conversions. If they weren’t so successful, it’s worth trying out some new offers to capture the procrastinators.

Make sure you’re dialed into what your customers want from your sales by reading reviews, listening on social media channels, or even doing a quick survey on your site or via email (ideally incentivized in some way). Build holiday deals and bundles that aren’t just gimmicks, but actually meet your customers’ needs. The current economic climate means your audience is looking for value, not just excess, so you’ll need to offer more than a token discount to pull in new customers and keep existing ones loyal to your brand.

Your creative needs to reflect those learnings. If you have a truly scroll-stopping holiday offer, shout it from the rooftops. User bigger, bolder text to stand out from the crowd. Make sure to let viewers know that the sale is only for a limited time and be clear about shipping guarantee limitations to incentivize them to click now. You should also test variables like “20% off” vs. “$50 off” to see which works best for your audience. Above all, make your ads clear and concise: there are a lot of brands looking to snag customers during the holidays, so let your audience know right away exactly what you’re offering to get their attention.

The endgame of the holiday season is a great time to earn new customers. People want to get great gifts that will arrive by the big day at a lower cost, and they’ll be more receptive to new products and brands right now. Get in front of them today to turn those seasonal shoppers into fans of your brand all year long.

Once you’ve pulled in new customers, you need to deliver a great customer experience to keep them. Before promoting a product, check your inventory to make sure it’s in stock and can be delivered before the holidays.

If users click through your ads only to find an out-of-stock notice or late delivery, you’re setting them up for disappointment.

Black Friday and Cyber Monday may be over, but there are still plenty of opportunities to capture more revenue before it’s all over. Take a look at what worked and what didn’t for your brand this BFCM and leverage those learnings for the rest of the year. If you play your cards right, your brand could be looking at a record Q4 by the time the ball drops this New Year.