At long last (and still somehow too soon), Apple launched the iOS 14.5 upgrade this week and marketers everywhere hunkered down to prepare for the worst: would CPMs start precipitously dropping or climbing? Would all of your ad platform reporting start a cool game of hide and seek? Would the disembodied spirit of Steve Jobs appear on every Apple device strumming Bono’s guitar and inform users that only Apple should be allowed to track all of their activities and behavior to personalize ads because only Apple is nice and good and wise?

The short answer to all of those questions: no. But we’re not out of danger yet.

While the sky may not be falling, it’s certainly getting closer as the privacy sea levels continue to rise.

That’s why we pulled together a braintrust of experts across digital intelligence, paid social, paid search, and earned media to tackle the key questions around iOS 14.5 and the enforcement of App Tracking Transparency (ATT), specifically:

- What do we know?

- What do we hypothesize will happen next?

- What do you need to do right now to be prepared?

Right Now: How is iOS 14.5 affecting marketing now that it’s launched?

The good news is that the worst-case scenarios did not come to pass: we didn’t fall off of a data cliff. But we are likely on a hang glider at the moment with some rough winds ahead. Let’s dig in:

Cost: Are CPMs and/or CPCs being affected?

We built out client cohorts in advance of launch so we could identify any anomalous behavior in CPCs or CPMs across Facebook and Google, and we’re not seeing any huge fluctuations (like we saw earlier in the pandemic) at this time.

But we do expect to see changes coming. There’s a couple of reasons we think these haven’t hit yet:

- Early adoption rate is low: Historically, adoption rate of a new iOS upgrade hits about 50% one month after launch, and around 75% at the end of the next month. Right now, there likely just aren’t that many devices on iOS 14.5 yet. Keep an eye on that progress with Flurry’s daily iOS 14.5 opt-in rate tracker.

- Data latency could be a factor: There is a latency period of about 72 hours tied to the scope of the data being captured and modeled by Facebook, so we probably aren’t seeing everything happening between Monday and right now quite yet. Think about it like election night 2020: Florida is reporting results early, but the real story will unfold once the polls close in Georgia.

- Marketers aren’t reactive to the news: In general, marketers tend to take a wait-and-see approach; it’s not until performance is impacted that they will start to move or restrict budgets. We expect CPMs to maintain until performance dips.

That dip in performance is probably a “when” not an “if,” but it won’t necessarily happen to every brand at the same time.

Marketers will face a reckoning, but individual brands won’t all respond the same way.

Some might shut off some ads, some might move budget to other channels, some won’t change anything. Those responses, especially from big spenders, will in turn cause fluctuations in CPM and CPC across channels to hit specific industries and ad categories in different ways, at different times. Indeed, both the length of conversion cycles and margins will likely factor heavily into these decisions, with some (mostly larger) brands able to wait out the storm and search for survivors in the morning.

We also know that most major SAN (self-attributing networks) ad platforms aren’t yet accepting data from Apple’s SKAd network (SKAN). Until the ad networks support SKAN postbacks to MMPs, marketers will not be able to observe conversions and other events for iOS 14.5+ users.

Snapchat (and now Twitter and TikTok) is a major exception here and leading the way in supporting SKAN postback to MMPs, as are some large non-SAN ad networks like Criteo. But it’s important to note the difference between the individual SKAN postbacks supported by Snapchat and others and the large-scale aggregate SKAN data we’re expecting to see from Facebook in the future. Marketers will be able to observe conversion events once Facebook starts supporting SKAN postbacks, but aggregate SKAN data will mean reporting delays and lower resolution in general.

Conversion: Am I losing visibility into my channel-specific conversion data?

The biggest single fear advertisers are facing is loss of visibility into channel-specific conversions, and while we’re not seeing widespread breaks in conversion data right now, they are still on the horizon.

Pixels will someday soon be a relic due to the inevitable and continued mitigation of in-browser tracking technology, and marketers will need to adapt accordingly.

That doesn’t mean you won’t see anything on the channel side; instead, you’ll be relying on modeled data. That’s not exactly new; Google, for example, has been doing it for years for conversions the platform can’t “directly observe,” like in-store conversions.

But that Google example is also useful to illustrate the limitations and challenges of moving from relying on deterministic to probabilistic modeling, which will be happening across the board on platforms as additional privacy restrictions roll out. Platforms like Google and Facebook treat modeling as a black box, and give little information into what real data those models are based on, what conditions are being applied to that data, and how exactly the models work.

The in-store conversion example is a rare instance in which Google has revealed what data the model is using: 2% of Android users (although they do publicly state that any data shown in the platform meets a 95% significance threshold). That’s tiny, and not necessarily a good stand-in for all in-store customers—and is a great illustration of why marketers need to adopt a trust-and-verify approach whenever possible (which we’ll discuss in further detail in the actions to take section).

Changes to Facebook Conversion Reporting

[Update 5/6/2021] The changes to attribution windows in Facebook have impacted the ability to access accurate aggregated reporting across campaigns with different attribution windows in the Ads Manager Interface. In the past, you could compare campaigns apples-to-apples using the now-retired 28-day click, 1-day view default window (or any attribution window of your choice), no matter which attribution window they were optimized for.

But those days are gone: you can now only view attribution data for the window an audience is optimized for in the Ads Manager Interface, without a way to standardize the reporting to look at the big picture across campaigns. Let’s say you have campaigns optimized for the 7-day click and 1-day view attribution window, and other campaigns set up for 1-day click: you will now only see attribution data for your chosen attribution window instead of a holistic aggregated attribution set. On top of that, any campaigns optimizing for a non-direct response event (i.e. traffic, reach, video views) will lose the ability to report out performance in Ads Manager

Changes to Google Conversion Reporting

[Update 4/30/2021] Google is not collecting IDFA and is taking steps to fill in the gaps. They just announced a change to the way ads served on “a handful of Google apps” will handle clicks: the familiar GCLID parameter will not be appended to landing page URLs resulting from an ad click that occurs on iOS 14. We expect this will result in fewer landing page views with GCLID values in reporting.

In addition, Google is introducing a new URL parameter (no confirmation on what it is, but speculation is that it could be WBRAID) to bolster measurement of ads served to iOS devices. They also added a new first-party cookie (set via GTAG, GA or GTM installed on a website) that will attribute conversions back to ads served on iOS 14.5 devices. In the short term, that means you should expect to see fewer reported conversions, but in the future we predict the new URL parameter and the new cookie will help bridge conversion reporting gaps.

Opting Out: Are people opting out of tracking now that they’ve upgraded?

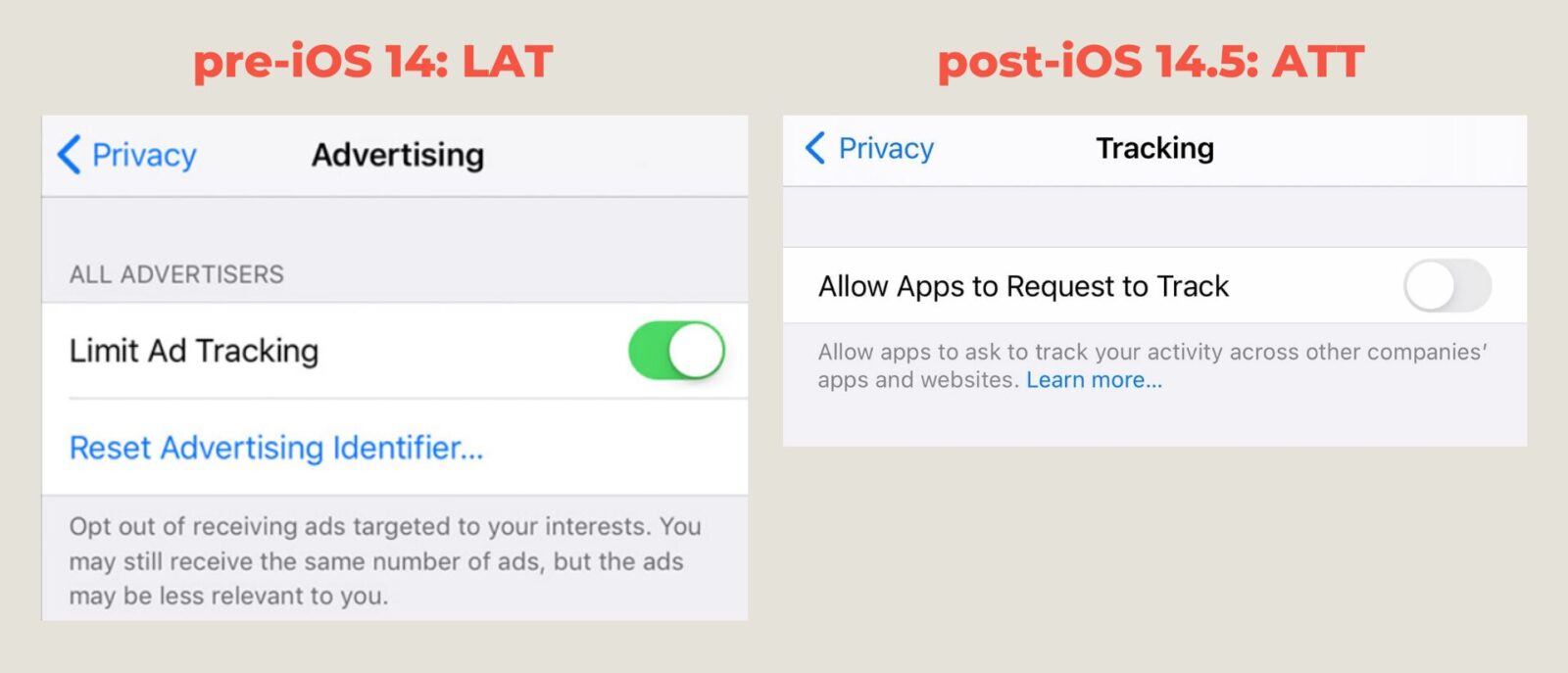

This one is still largely TBD, but we included here because there is something new we know: Apple is using a privacy setting called limit ad tracking (LAT) from older versions of iOS to automatically opt users out in a way that is likely to significantly decrease the number of users even seeing prompts to opt into tracking.

In an internal straw poll, we found that approximately 60% of our employees had the “limit ad tracking” option turned off. For the 40% that had it turned on, they were opted out by default across all apps. That’s about on par with this research from Singular:

![]()

This is a pretty disingenuous inheritance: opting into Limit Ad Tracking on your phone is not the same thing as opting to not allow apps to even ask for permission to track, especially given how robust the ATT policy is by comparison.

There is a separate opt out for Apple’s own advertising, deeper in the privacy settings. It’s also called “personalization,” as opposed to “tracking.” About 35% of our straw poll had opted out of Apple’s ads as well. Both functions appear to be persistent once users upgrade.

While it’s not an exact science, it will mean that for an app with an average opt-in rate of ~26% (per AppsFlyer), it’s possible that now only 26% of 60% of their users will even see the prompt.

That takes opt-in rate down to a lowly 15% and creates an even steeper decline in available data.

And it compounds from there: the user needs to opt in to both apps and not be opted out by default to stitch the data together. That’s more like needing to shoot an arrow through two hoops and still hit the target.

Our Predictions: What will happen next now that iOS 14.5 is launched?

Full disclosure: we don’t know exactly what will happen, but we have some strong educated guesses as to what we’re likely to see across the coming months:

iOS and Facebook Marketing

There are several major ways iOS 14.5 is likely to hit advertisers on Facebook:

- Campaign Performance: We are anticipating depreciated results attributed in the Facebook Reporting User Interface caused by the sunsetting of the default 28-day click and 1-day view attribution window, as well as the impact that the update will have on 7-day Click and 1-day View windows for users who have opted out. Users who have opted out will only be able to pass back 1-day click data on the highest configured event. We also want to note that 1-day view windows moving forward will now be modeled. We will continue to analyze the depreciated numbers we’re seeing in the Facebook UI, and look to identify how attribution might be shifting to other buckets like direct.

- Audience Size: We believe we’ll see a reduction in audience sizes of remarketing pools built off of Facebook Pixel Signals. This has the potential to impact retargeting and retention efforts that utilize these audience segments. Lookalike Audiences built on seed audiences from the pixel pools may potentially be impacted as well. Interest-based targeting is likely to emerge relatively unscathed because it’s largely based on self-reported user information on Facebook. Along with that, the utilization of 1st-party data and CRMs will become more important than ever for creating retargeting and retention audiences, as well as seed audiences for Lookalike Audiences creation as we shift into this new marketing dynamic.

- Platform Costs: We project that fluctuation in CPMs and CPCs on Facebook is still likely ahead of us, which could result in spiking costs and low inventory on other platforms as brands look to diversify spend away from Facebook. We will also be monitoring the shift in inventory, spend allocation, and impressions from Apple devices as compared to desktop and Android users.

- Attribution & Measurement: Of course, this has been the most well-documented aspect of changes on Facebook (and other social platforms) and includes a wide variety of issues including conversion feedback latency, a decreased attribution window (now a maximum of 7-day click, 1-day view), increased data modeling and in some cases, a loss of attribution entirely.

- Automated Rules: If you use Automated Rules, you need to monitor and check them: they will have automatically been changed to a 7-day click attribution window, which could impact the actions of the rules if it was previously set to a different window. You also won’t be able to adjust or specify a different attribution setting for automated rules, and some of the capabilities will be unusable if you aren’t optimizing for 7-day click.

- Experiments and Testing: iOS 14.5 has restricted the ability to run certain tests. Self-serve conversion lift tests, which used holdouts groups to measure campaign incrementality, will no longer be available. Cross-publisher conversion lift tests, which were still in beta but designed to measure incrementality across Facebook and another publisher, are also going away.

We do not think that all of the effects of the iOS 14.5 update will be felt right away, but will have a rolling impact over the next few weeks.

Because there is no exact date when CPMs and CPCs will change dramatically, it’s likely to be difficult to determine correlation vs. causation, but our teams will continue to monitor this closely and update accordingly with new information and data as it surfaces.

iOS and Google Marketing

The likely long-term effects of iOS 14.5 on Google are more muted than what we predict for Facebook. Here’s what we expect to see initially:

- Search: We don’t believe that iOS 14.5 will have any major impacts on search measurement, but we expect that first party audiences will start to shrink, which may impact search campaigns geared around those audiences.

- Display: It’s likely that iOS 14.5 will break the data chain for mobile conversions happening in places like mobile apps where the ATT prompt has not been accepted. As a result, reporting may misattribute some of those conversions as direct traffic.

- YouTube: There will probably be a similar effect on YouTube app interactions and conversions for users who are not logged in.

- Apps: App campaigns targeting iOS devices will be the most affected, as our ability to use the IDFA to stitch together performance insights will be inhibited. iOS-based App campaigns with heavy use of image and video creative or that run primarily on GDN or YouTube networks could see major reductions in visibility on down-funnel event volume, as users who do not opt to be tracked will not pass along event data back to Google. SKAd Network-supported conversion data will be available to pass back anonymized event data, and MMPs have upgraded to support capturing these postbacks, but unless you have Google for Firebase installed, you won’t be able to ingest your MMP events back into Google yet until later this year when it is supported.

In general, we will probably see measuring “halo effect” become more important as conversion attribution shifts away from paid traffic that was formerly attributable by capturing IDFAs. It’s entirely possible we will have to get more creative about upper funnel performance measurement in the future because channel attribution will become less effective.

Take Action: What do you need to do right now to be prepared for the continued iOS 14.5 rollout?

The shift to probabilistic modeled conversions will almost certainly be the biggest change and challenge for marketers moving forward, but it won’t happen overnight. There is time to get your house in order to be as prepared as possible for the privacy-first future:

- Make first-party data collection a priority and build CRM/CDP data around it. You need to reinvigorate your 1P data strategy if you haven’t already to bypass cookie based/IDFA based audiences. That means not just collecting at the point of conversion, but building community campaigns and initiatives early in the funnel to earn the ask.

- Capture and aggregate your data across multiple sources. Many advertisers are over-reliant on either their backend CRM data or on channel data, but the shift to modeled data means that neither is sufficient. You need to look at both, in tandem, to understand a more complete picture. Your channel data will give you a view into things that have to be modeled or extrapolated, while your backend CRM data can help validate how accurate the modeled performance data is. Everyone in marketing is working toward a solution, but at present the main things you need to pay attention to are:

- Data loss: what isn’t being recorded or attributed in platform analytics?

- Data overlap: how closely aligned are the results your platform is reporting vs. your actual purchase data?

- Get comfortable testing and verifying your platform data. Evaluate how you plan to validate platform data through incremental testing to calibrate platform models. Remember that this testing needs to occur across all channels: incrementality in a silo will only validate one thing working right now. That kind of testing is particularly challenging because of the fluctuations over the course of a year of pandemic changes. The only way to fully validate is an overarching lift analysis

- Explore channel diversification. Start building out part of your budget to put toward testing new and/or emerging channels so you’re not over-reliant on a single source that could be impacted by further privacy changes.

- Test your ATT Prompt. Experiment with messaging, how quickly you’re serving them to users in app, and other factors that might affect opt-in rates. Check out this gallery for additional inspiration!

Want to learn more about the wider state of data privacy in 2021? Check out our free whitepaper to explore the entire landscape of upcoming changes to your marketing data.

Contributing Experts: Jason Ford, Jared Smith, Christina Weir, Brad McGuire