Performance marketers are facing a new reality: traditional platforms aren’t scaling like they used to, and acquisition costs are only going up. That’s forcing growth teams to rethink their mix and start looking at upper- and mid-funnel channels they used to ignore. One of the biggest underleveraged opportunities? CTV. But only if you get CTV measurement right.

The rise of CTV and its challenges

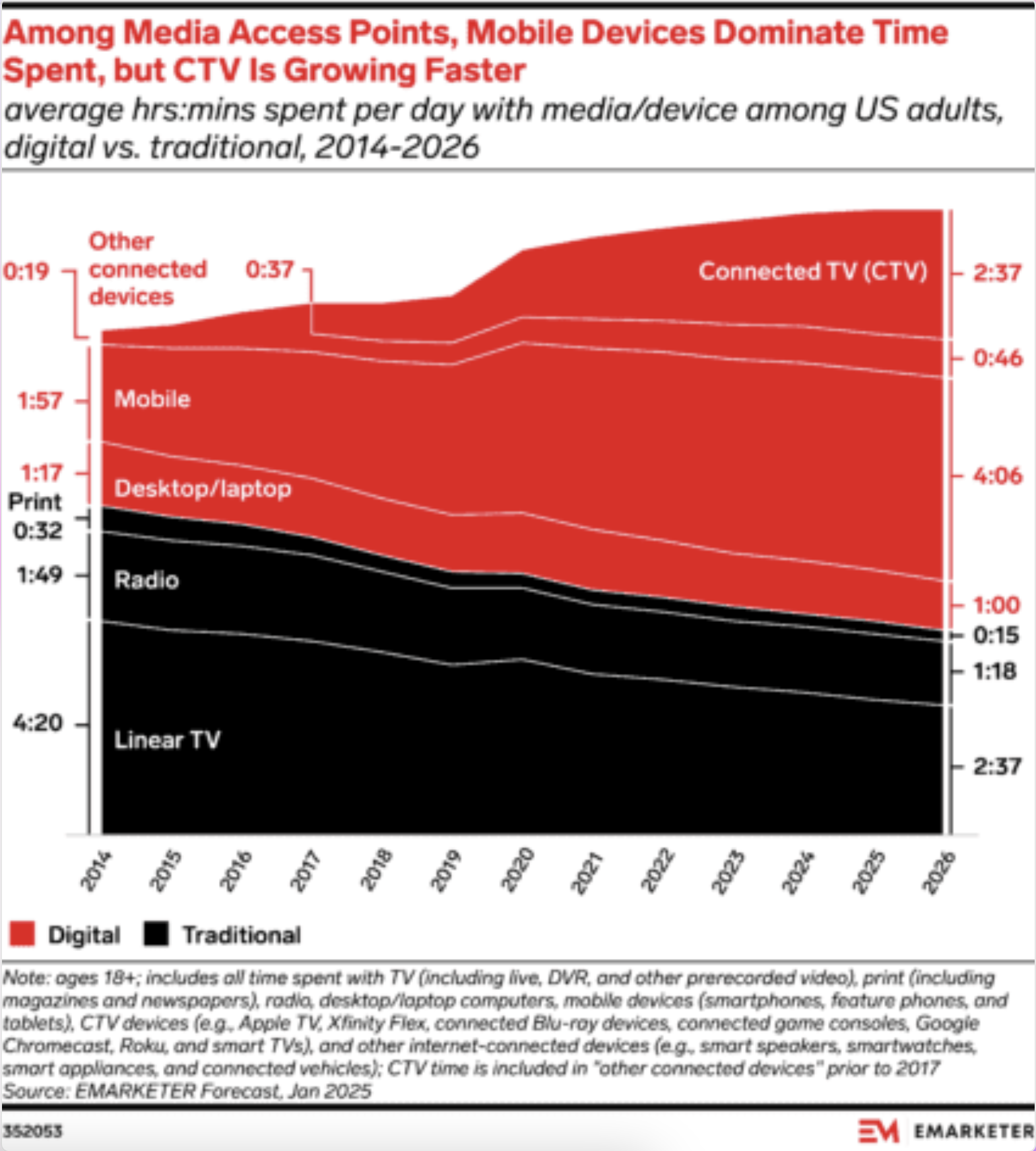

US adults will spend almost two and a half hours a day with CTV in 2025. That makes it a major opportunity to gain attention from broad audiences, and advertisers are taking notice: US CTV ad spending will rise to $33.48 billion in 2025.

The rise of multiple ad-supported streaming services and tiers means brands have more opportunities to get in front of those customers than ever before, but that fragmentation also presents a real challenge from a measurement perspective. With a lack of clear standards, a patchwork of solutions, and longer lead times than digital-focused performance marketers are used to, holding CTV investment accountable isn’t easy. To triumph over unclear metrics, murky attribution, and platform proliferation, brands need a modern approach to CTV measurement. The good news? Performance teams that solve the measurement conundrum will help drive real impact across the media mix.

Performance power: why invest in CTV?

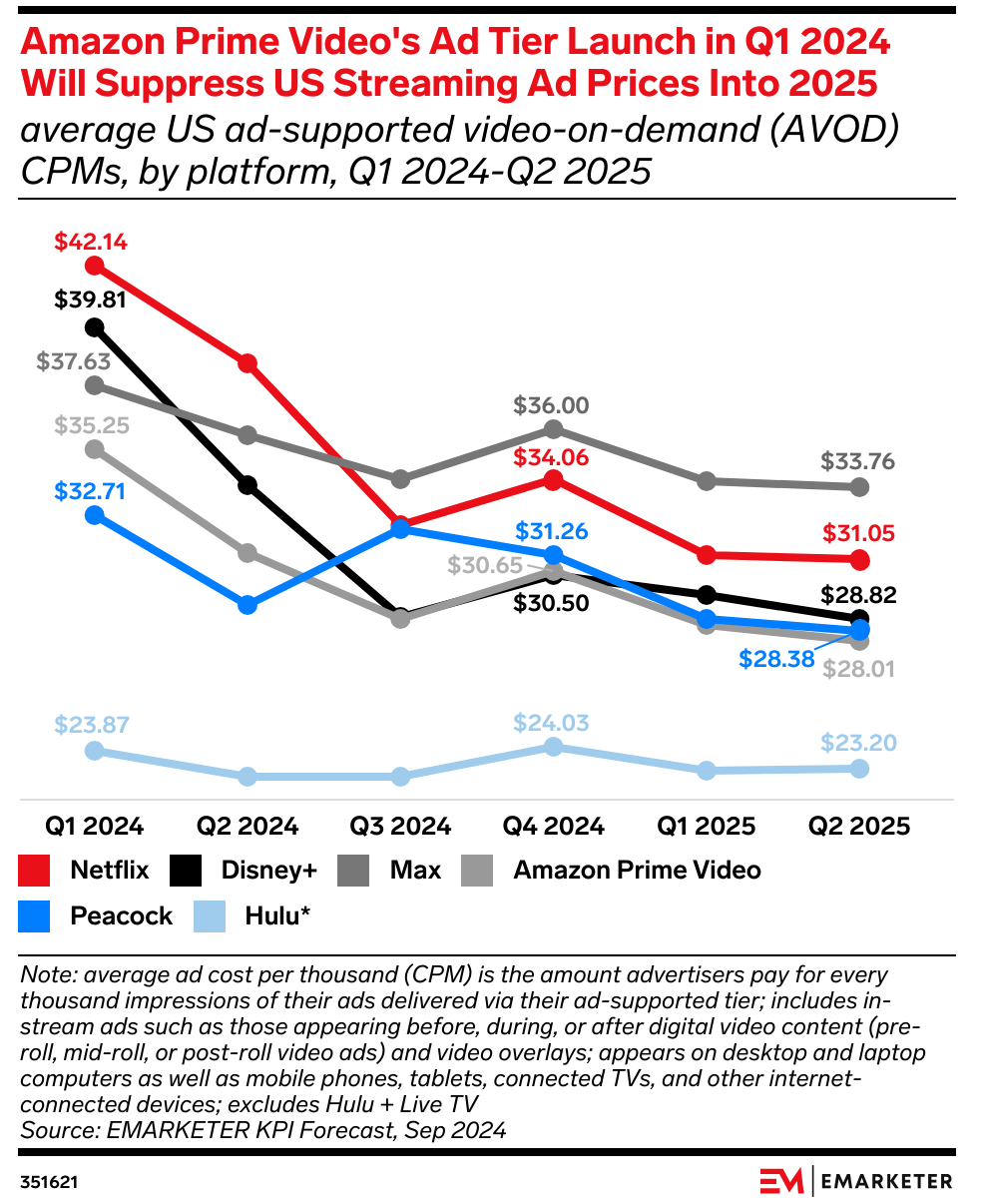

If you’re a performance marketer, CTV might feel perilously close to a brand play (after all, “TV” is right there in the name). So why lean in? In 2025, the rules of performance marketing have changed. Platform saturation, rising CAC, and a more fragmented path to conversion mean performance teams can’t afford to ignore upper- and mid-funnel influence anymore. Performance is now truly a full-funnel sport. CTV gives you the chance to reach prospective audiences before they’re actively shopping, when CPMs are cheaper. This seeds demand before the competition kicks in and warms up the audience for more efficient downstream conversions in channels like search and social. Meanwhile, CTV advertising costs—especially on AVOD platforms like Amazon Prime Video, Peacock, and Hulu—are falling as inventory surges. That means there’s no time like the present: CTV is more affordable and scalable than ever before.

CTV measurement: myth vs. reality

Historically, TV was dismissed by performance teams as an expensive proposition without proven impact. But CTV has changed the game; while CTV measurement is still a challenge, it offers a lot more opportunity for marketers to quantify the actual business impact of their investments. Let’s take a look at (and shoot down) some commonly held beliefs about CTV:

- Myth: “I can’t measure performance if it doesn’t drive direct conversions.”

- Reality: CTV doesn’t convert on click, but it drives search, site traffic, and assisted conversions across your funnel. A strong incrementality testing strategy will help you prove out the direct impact of CTV on the bottom funnel.

- Myth: “CTV’s brand metrics don’t help my goals.”

- Reality: Intent indicators (like branded search volume, site lift, YouTube view-through rate) can help you understand downstream efficiency. Used right, they tell you which audiences are warming up before they click.

- Myth: “MMM and GRPs don’t actually evaluate impact.”

- Reality: A comprehensive approach to CTV combines strategic planning, real-time monitoring, and thorough measurement so you can both predict and evaluate success with short-term KPIs while keeping sight of long-term goals.

Here’s the truth: you need to balance long-term brand success with clear visibility into immediate performance indicators. Both are essential to maximizing agility and accountability in your CTV strategy. Let’s dive into how you can take advantage of the channel with the right measurement mindset and approach.

Obsessed with accountability: how to get CTV measurement right

To win, marketers need to treat video as media that can drive upper-funnel brand lift, build mid-funnel consideration, and hold all media as accountable as traditional performance media. Getting CTV measurement right starts with figuring out where CTV is actually driving incremental value. That means going beyond impressions and completion rates and tying exposure to intent signals, brand lift, and actual business outcomes. CTV metrics must align with real value to the business, not just vanity numbers. Results on CTV take more time than performance marketers are used to. But that doesn’t mean you should just sit back and wait for something to happen once your campaigns go live. Instead, optimize upper-funnel media in real time based on short-term KPIs while measuring its impact on long-term business goals. You have to track the right metrics for the right period of time:

- Short-term: Click-through, view-through, branded search

- Mid-term: Site lift, engagement, remarketing pool growth

- Long-term: Incrementality testing, market share

CTV today provides an opportunity to bring together brand and performance measurement.

Pulling it together: measuring CTV’s impact

Wpromote helps brands unify reporting by integrating platform-specific insights into a single strategic view, not by forcing a one-size-fits-all framework. The key is translating metrics across platforms into a common language: impact. Older forms of measurement, like traditional media mix models (MMM) and TRP/GRPs, won’t cut it on their own. Instead, you should be measuring CTV’s full funnel impact on your business goals. Did a campaign drive brand awareness? What about sentiment or loyalty? How did it affect consideration? Did it ultimately influence or even drive the purchase decision? View-through and click-through metrics can measure immediate efficacy. Total impact across channels (since the ultimate conversion will take place elsewhere) can be measured via a high-velocity MMM combined with incrementality testing like Wpromote’s proprietary Polaris Growth Planner.

Laying the foundation: building a strong CTV measurement framework

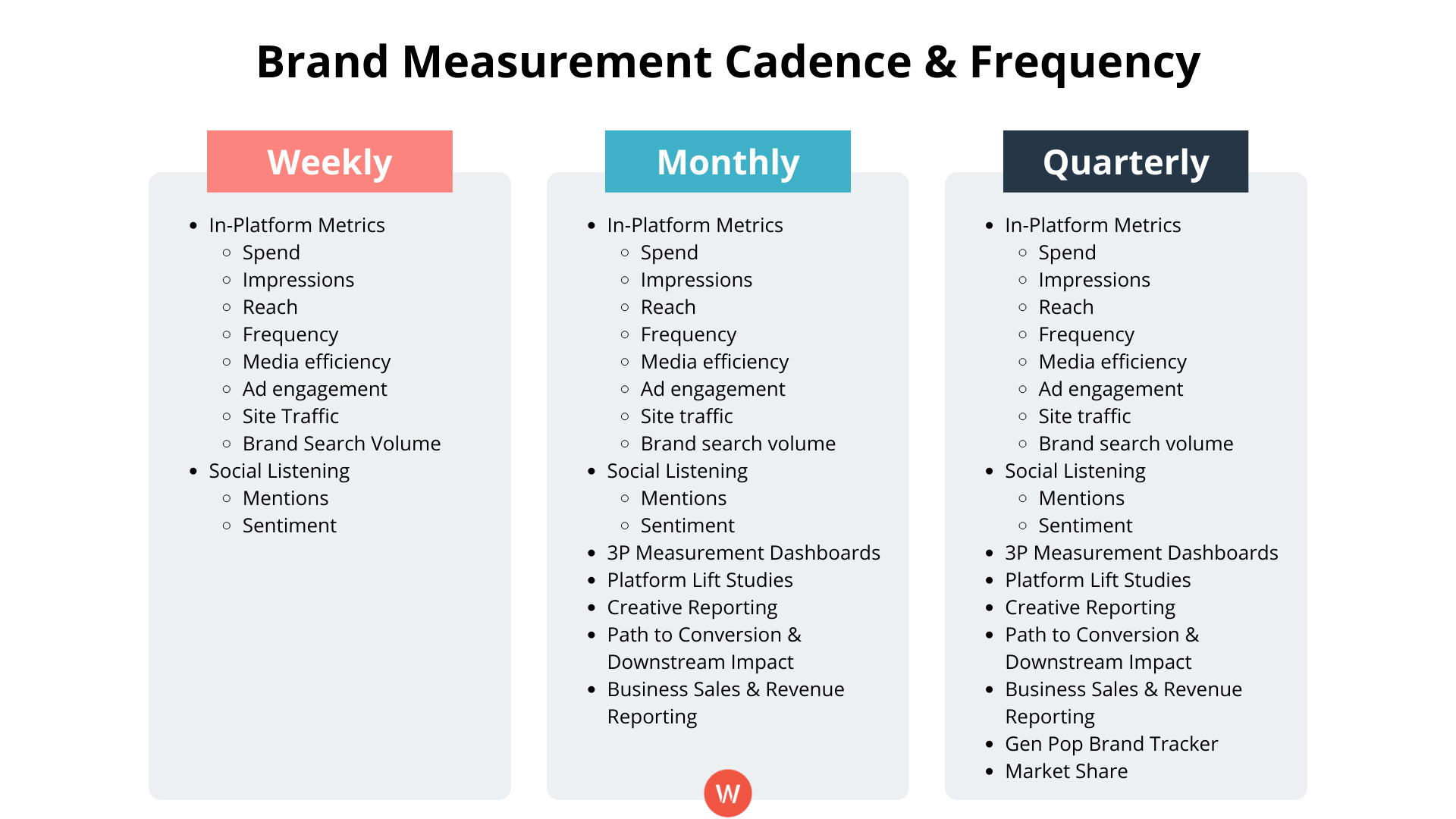

Bringing short- and long-term metrics together is a good start, but you’ll need a strong measurement framework in place to get the full picture of CTV performance against business goals. Make sure your measurement framework is set up to facilitate cross-channel measurement, including a high-velocity MMM. Incorporating platform analytics like engagement and spend can show you how efficiently these tactics are driving acquisition. You can complement MMM optimization with multi-touch attribution (MTA) to get more insight into user-level, real-time touchpoints. But that alone isn’t enough. To get a complete understanding of how many new customers you’re actually generating through marketing activations, you’ll also need to implement incrementality testing, running controlled tests to isolate the impact of the channel to ensure you’re allocating budget for optimum results and your efforts are actually making a difference. That will help build out a full feedback loop that refines modeled outputs with real marketplace performance. It’s a good idea to set up a weekly, monthly, and quarterly measurement frequency to highlight the leading vs. lagging indicators based on the amount of data required to get an actionable read.