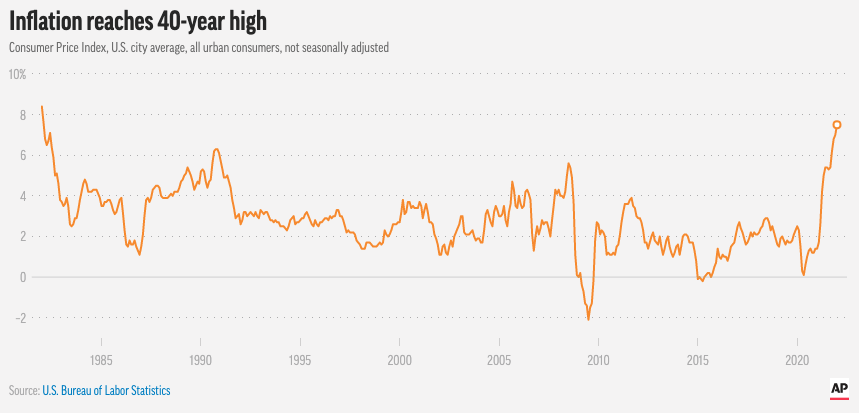

As inflation hits a 40-year high in the US, businesses across virtually every industry are feeling the impact, and economists predict it’s going to get worse before it gets better.

Marketers need to adjust their strategy now to find a path to performance through a tough economy, when consumers are spending less on non-essentials and prices are on the rise across the board.

So how can you get creative and find a way to make your brand stand out to budget-conscious potential customers? You need to start by understanding the underlying causes of inflation and how they impact consumer decision-making.

What is causing inflation and how will it impact your business?

Inflation refers to a sustained rise in overall price levels. We’re not going to do a deep dive into economics here, but you should know that it has the sneaky ability to undermine and, in severe cases, completely disrupt consumer demand for non-essential products and services. And we’re in the midst of a serious period of inflation.

Nobody is sure when inflation will subside. Economists now believe inflation may be worse than previously expected across 2022. “The inflation picture has worsened this winter as we expected, and how much it will improve later this year is now in question,” according to a report from Goldman Sachs.

So how did we get here and why is inflation so high? Like most problems over the past two years, the pandemic turned everything upside down. The global supply chain is out of sync due to Covid-19 shutdowns and restrictions on manufacturing and production, including further strain caused by increased consumer spending in the United States.

In the present tense, Russia’s invasion of Ukraine and the resulting international sanctions are likely to drive prices up even further, particularly gas and food. The sanctions enforced on Russia are also likely to exacerbate the current shortage of microchips and issues with the semiconductor supply chain that are impacting many industries like automobile and phone manufacturing, further complicating supply chain issues.

The Federal Reserve is likely to raise interest rates in an attempt to tamp down inflation, with some estimates predicting a 0.5% increase coinciding with the March Federal Open Market Committee (FOMC) meeting and potential further hikes at subsequent FOMC meetings in 2022. But higher interest rates may stifle demand at a time when slowing economic growth brought on by surging commodities prices amid the Russian invasion of Ukraine might require a continuation of easy Fed policy.

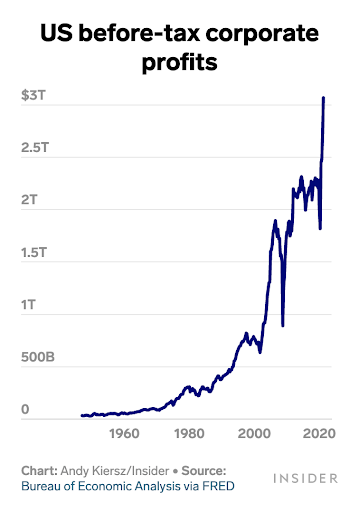

So, how will all of this affect your business? Bigger brands can take advantage of the inflationary period and set their own prices, which ultimately passes the cost onto consumers. That’s why some businesses are reporting record sales and profits are trending upwards.

But it’s not quite so simple; as profits have grown, businesses have been forced to spend more to keep and attract top talent in a tightening labor market. With more employers chasing a limited number of qualified workers, wage growth is rising faster now than in 2020 or 2021.

Even if your business is seeing spectacular profits, you can’t afford to ignore one of the biggest ways inflation makes an impact: consumer spending.

How is inflation affecting consumer spending?

Consumers are worried about rising prices as a result of inflation; according to Ipsos, nearly two-thirds of consumers are worried their budgets can’t take any more stretching. At the height of the pandemic, consumers were setting records for discretionary spending because of the stimulus packages and budget re-allocated from categories like travel and dining. Now, as prices skyrocket, consumers are spending on essentials first and foremost.

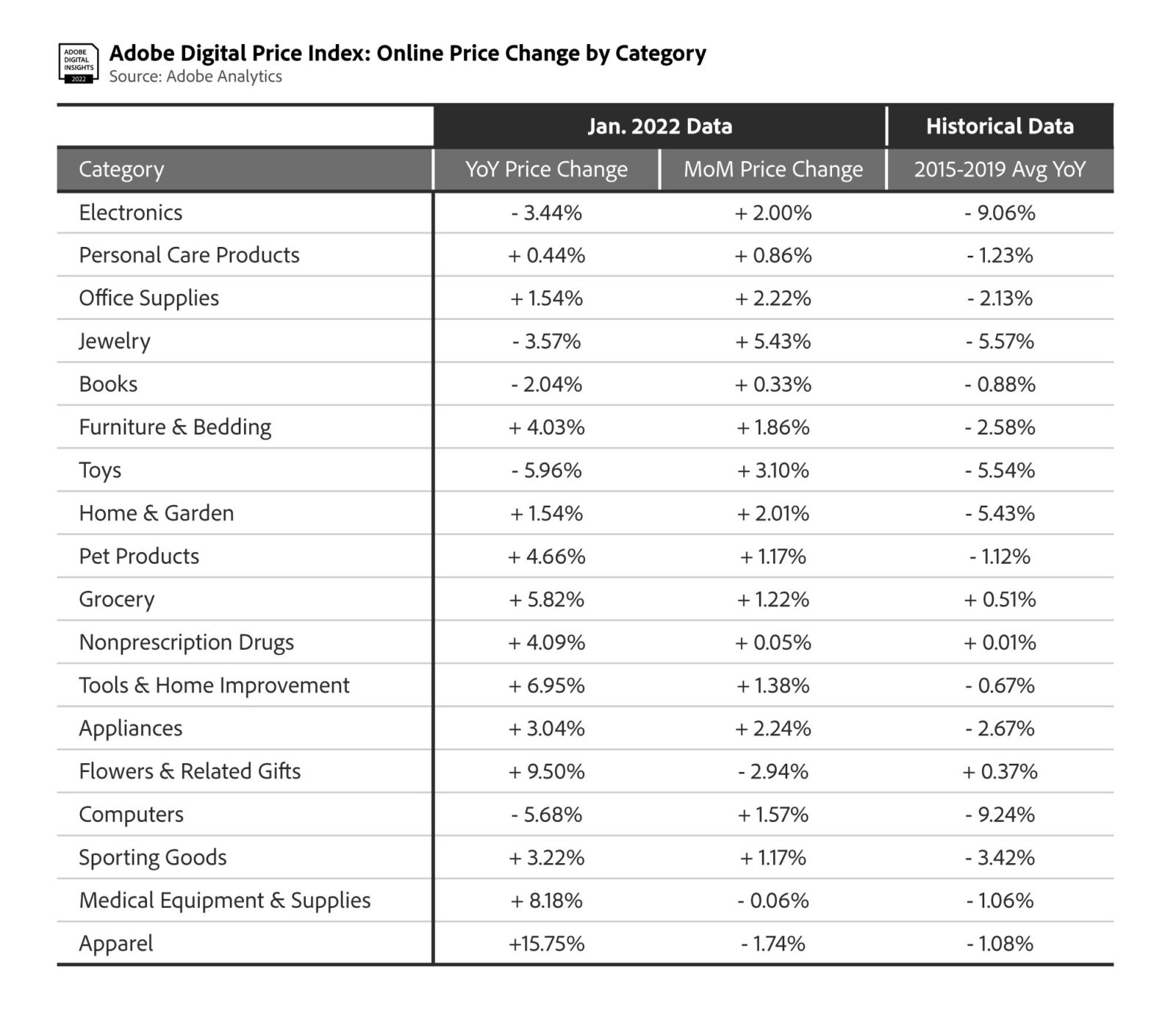

January 2022 marked the 20th consecutive month of online inflation, and the effect on consumer behavior is clear. Consumers are buying less, and when they are buying, they’re looking for deals and shopping at large retail chains like Target and Walmart. Marketers need to adapt their strategies in response.

How should you adapt your marketing to consumer spending and behavioral changes caused by inflation?

Inflation is probably not going anywhere for the foreseeable future, and consumers are likely to grow increasingly particular about what they’re spending money on and which brands they choose to buy from. So how can your brand effectively connect with consumers during this stressful time and show they care while capitalizing on opportunities for growth?

As prices rise, consumers will rely more and more on budget as the primary factor in their purchase decisions, which means comparison shopping for the best deal will become increasingly central to the customer journey. Brands need to invest in mid-funnel consideration campaigns that showcase price and value to bring new customers in and retain existing customers.

Find ways to show value without lowering prices or offering discounts:

- Lean into differentiation and don’t follow the herd: Evaluate how your brand is positioned in the market and what your direct competitors are doing, particularly if they are pulling back on spend. Brands that are willing to invest during periods of elevated inflation can seize the opportunity to steal market share from the competition if they’re pausing or slowing investment. If competitors are pulling back on media spend, consider whether it would make sense to continue to invest and own the market while media costs are lower.

- Offer new payment options: Consumers are prioritizing money in hand right now, so explore the potential value of adding buy now, pay later services. According to a Lending Tree survey, nearly a third of consumers used a service like Klarna or AfterPay, and nearly two-thirds have done so five or more times, with 81% saying they’re likely to use it again.

- Leverage loyalty programs: 104 million Americans use loyalty/rewards programs, and investing in those programs can serve as a core defensive strategy against the rising tide of inflation. Think of loyalty programs as a protective moat around your core business and customer base that can help you stop the competition from eroding your brand’s market share.

- Create bundles or value packs that offer more utility: As prices rise and consumers begin cutting non-essential items from their budgets, brands must effectively communicate their value proposition and benefit to customers. By offering compelling savings or bundling products and services, brands can turn their most loyal customers into brand advocates. On the flip side, it may also make sense to unbundle products if that makes them more accessible to price-sensitive customers.

- Don’t make assumptions about what’s causing sales declines: It’s easy to point at inflation or the pandemic as the reason behind a decline in sales, but you need to take a magnifying glass to your top-line revenue to diagnose the actual cause before you pause media spend. Keeping the lights on (in media spend) may help you figure out the next steps and identify solutions and opportunities in the market. Remember: consistency and visibility are crucial to your brand. Consumers are still spending time with media and branding should be considered a long-term investment vs. a short-term gain, which is why we don’t generally recommend pulling back on media spend without a clear reason why.

- Monitor consumer behavior: Leverage search trends and consult consumer strategy experts to make sure your business stays ahead of the curve and can respond to what’s happening in your specific category to your most important customers.

With no immediate end to inflation in sight, you need to find opportunities to win over new customers and position your brand effectively to align with changing consumer priorities. Deploying campaigns to acquire and retain customers in a challenging economic environment isn’t easy, but it’s achievable with the right strategy driven by real-time insights.