Another Prime Day is in the books, and we’re ready to share everything we learned so you can prepare for the next peak buying season: Cyber Week.

But first, let’s take a look at some general trends that emerged from Prime Day 2021:

- Despite dates changing up until the last minute, Amazon Prime Day 2021 generated record-breaking sales that surpassed $11 billion, according to Adobe Analytics data.

- Year-over-year (YoY) sales growth, however, hovered at just 6.1%—down from last year’s increase of 45.2%. While we anticipated a slight decline in YoY sales growth over time, we were surprised to see such a significant drop-off.

- Competition remained fierce: third-party sellers outsold Amazon’s own retail business for the second year in a row. Amazon’s Search auction increased in saturation during the weeks leading up to the big day as many brands and marketers rushed to outperform last year’s sales. There were also more (and higher quality) deals, coupons, and discounts available to shoppers during peak periods.

In short: it’s absolutely necessary to make sure your business is ready to perform as efficiently and strategically as possible if you want to successfully cut through the noise, tap into new audiences, and maintain momentum going into the holidays.

So let’s dig deeper into what worked and what didn’t on Prime Day 2021, and how we can apply them to Q4 and beyond.

1. Amazon DSP outperforms sponsored ads

Since the start of the pandemic, we’ve seen a gradual shift in performance on Amazon’s Display and Search platforms, which may largely be due to changing consumer preferences and buying behaviors.

Specifically, competition for Amazon’s Search auction increased significantly as we closed in on Prime Day, with brands scrambling to stabilize supply chains, ramp up digital ad spend, and strategically invest to move units as quickly and efficiently as possible, resulting in a steady rise in Search cost-per-clicks (CPCs).

Display ads, on the other hand, remained a more difficult entry point for many brands. In fact, many heavy programmatic players, like brands in the airline, hospitality, and events industries, pulled back on competing in Display ad exchanges.

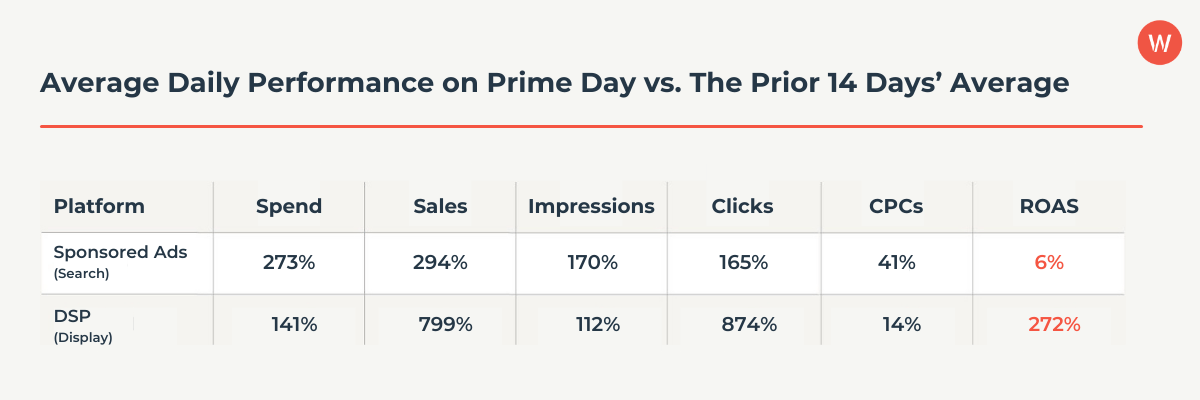

The culmination of these shifts came to a head on Prime Day itself: brands reported the best return on ad spend (ROAS) from Display ads, which increased by 272% on the actual day, compared to the 14-day window leading up to the event. Conversely, ROAS from Search ads only increased by 6% for the same period.

While Display ads are typically used to boost consideration and awareness, we found that most of our clients’ success came from leveraging Display and Video ad targeting throughout the mid- and upper funnels concurrently.

That said, Search ads will continue to remain a critical component to your overall success on Amazon. Using Search and Display tactics in tandem will allow you to not only capture demand from consumers who are actively searching on Amazon but also reach new audiences at scale.

2. Sponsored Brands boost lower funnel conversions

There’s also a new trend in Amazon Sponsored ads that’s been gradually accelerating since Q4 2020: Sponsored Brands are growing into a much more lucrative investment for marketers.

Sponsored Brands refers to cost-per-click ads that typically appear at the top of search results to help drive brand discovery for customers shopping for products like yours. These ads empower marketers to engage new shoppers through custom ad copy, images, and landing pages, providing a much more personalized, tailored experience (as opposed to the ecommerce-driven or “buy now” approach of Sponsored Products).

Due to their traditionally lower return compared to Sponsored Products and higher propensity to lead to an assisted purchase, these ads have commonly been used to target customers at the top of the purchase funnel and build brand awareness.

But in recent months, we’ve seen Sponsored Brands outperform Sponsored Products for lower funnel conversion metrics like ROAS.

This was most evident during Prime Day: across our client accounts, Sponsored Brands delivered a return of $8.62 on both days of the event, 31% higher than Sponsored Products and 77% higher than Sponsored Display respectively. Sponsored Brands generated higher overall conversions and lower CPCs than other ad placements.

But why?

We believe there are two primary factors likely to have caused this shift:

- Most marketers neglected to invest in strategic Sponsored Brands ad placements in favor of Sponsored Products, which are traditionally more ROI-focused. While we believe Sponsored Products should still be a priority in your Amazon marketing strategy, they should not come at the expense of embracing, testing, and optimizing Sponsored Brands to drive new customer acquisition, boost incrementality, and outmaneuver the competition.

- Over the past year, Amazon has expanded the functionality of Sponsored Brands to include new targeting options and additional ad placements towards the bottom of search results pages and on Product Detail pages. These extended features likely helped drive greater engagement and inspiration for customers at the start of their shopping journeys.

3. Amazon deals reign supreme

The Amazon shopping experience is all about convenience, great customer service, and (obviously) the deals. This is all the more true during Prime Day, when shoppers’ purchase behavior is nearly 100% driven by the power of promotions.

We’ve found that the strength of a brand’s coupon, deal, or discount relative to other similar brands within their category can have a make-or-break effect on overall marketing performance and sales success for the peak period.

Across our clients, brands with a strong promotional presence compared to category competitors generated Search ROAS of $6.86, 52% higher than those who offered weaker promotions (or none at all).

Marketers should lean on current marketplace/category research and prior learnings when determining which promotions (i.e. deep discounts, Lightning Deals, Prime Day Deals, etc.) will attract the most clicks and purchases.

Higher-priced, higher-demand categories like electronics will likely see success with a moderate promotion, while lower-priced, lower-demand categories like grocery should be more aggressive during peak periods to stand out from the crowd.

4. Second half of Prime Day surpasses expectations

Amazon kicked off their 7th-annual sales event earlier than expected this year (June 21-22), catching many shoppers off guard and likely causing some shifts in buyer behavior.

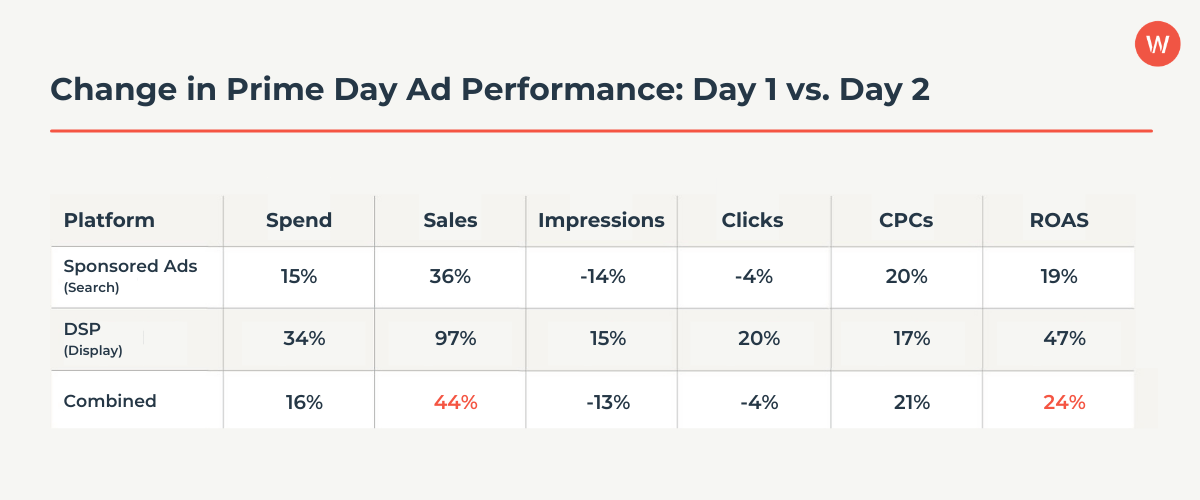

To our surprise, we found that day two of the event generated 44% more ad-attributed sales and a 24% higher return than day one when looking at Search and Display combined.

Historically, the first day of Prime Day (especially the first few hours) performs better than the second half. But this year, shoppers showed a little more patience before purchasing.

There’s still widespread uncertainty in the industry and beyond, and it’s more important than ever to proactively monitor and continuously optimize your accounts to achieve maximum results. One key reason our clients were able to buck the industry norm and outperform on the second day was because Wpromote’s experts were reacting in real time to results as they actually happened and proactively tweaking campaigns across Search and Display accounts across both days.

Consider tweaking your promotional calendar during peak periods to keep a discount running instead of prioritizing one day with a Lightning Deal if you want to make the most of high purchase intent.

How to leverage Prime Day learnings in your Cyber Week strategy

Now that the Prime Day dust has settled, it’s time to take all the tactical learnings gleaned from your Amazon Search and Display strategies and implement them into your evergreen campaigns immediately. Plan for the next peak period using these strategic takeaways:

- Consider implementing an always-on Display strategy to supplement your search efforts. Evaluate your total available budget and current search performance before making the shift. Pro tip: we tend to see stronger results from Display when the flight is scaled and optimized well before the peak period hits.

- Make Sponsored Brands a critical component of your search strategy before the next peak period. There are endless possible ways to customize and tailor Sponsored Brands ads to increase visibility, reinforce your brand messaging, and meet your performance goals. Marketers that are well-versed in these placements and equipped with creative learnings from testing initiatives early on will be in a good spot to take advantage of new Sponsored Brands opportunities as they arise.

- Start planning your promotional calendar as soon as possible to help inform your Search and Display initiatives. Conversations around ad budget and tactical deployment for peak periods should come after your promotional calendar is finalized. You should conduct thorough product category research to understand the strength of your prior promotions and help you decide which promotions should be part of your plans for the future.

- Prioritize Cyber Week in its totality, not one particular day or moment. The second-day results of Prime Day 2021 were a surprise to many, and priority resourcing for each account helped our clients maximize sales as conversion metrics fluctuated. As customer behavior continues to change, it’s critical that you have marketing experts dedicated to your accounts to carry out important strategic pivots and tactical optimizations as needed.

Responses