Upfronts and Newfronts are a key indicator of industry trends every year, and 2025 is poised to have its share of new developments. As Netflix considers expanding beyond TV and Roku and Samsung battle over the homescreen, there’s plenty for marketers to watch for at the upcoming presentations.

But those developments beg a more existential question: as media continues to converge, is there really a significant differentiation between the Upfronts and Newfronts anymore?

As everybody gets more digital and tech giants move into traditional media spaces, the biggest headline this year might be that all of this is just media—and smart marketers will be assessing offerings through a consistent set of criteria around audiences, capabilities, and accountability.

We’ve zeroed in on four key predictions for this year’s Newfronts and Upfronts to help you make sure you’re focusing on what matters the most for your brand, even if that’s hiding under the splashy headlines.

1. Closed-loop commerce experiences will be the holy grail at Upfronts 2025

Marketers are increasingly interested in the value proposition of closed-loop commerce experience offerings like TikTok’s, which allow consumers to check out right where they see an ad.

To capture some of the commerce power of TikTok Shop, we’re going to see many platforms try to create or accentuate this kind of closed loop within their own ecosystems or demonstrate their enhanced retail-centric efforts.

Amazon and YouTube will be showing off how marketers can go straight from a TV ad to a transaction on their platforms, while others like Meta will look to showcase stronger alignment between ad exposure and retailer sales.

We’re also betting that we’ll see more announcements showcasing partnerships with major commerce players for retail audience targeting–like Google’s recently-announced retail media solution for DV360, which will launch with inaugural partners including United Airlines, Intuit, Costco, and Regal Cinemas.

2. Netflix is coming for the ad platform streaming crown–and may be expanding beyond movies and TV

A few years into their ad-supported tier offering, Netflix is starting to find its groove as an ad platform. Netflix’s flexibility, recent success with sports livestreams, and ability to launch shows and new stars into the cultural conversation challenge the dominance of other streamers in advertising.

Now, the platform is making moves to take over more than just streaming. Netflix is expanding into some of the hottest advertising areas today by investing in sports plays and building in shoppable opportunities.

We predict they may soon start to capitalize on video podcasts and online creators in a play to grab attention from YouTube. While YouTube will serve as an incubator for emerging creators, we see Netflix’s future as focusing on inking more mature creator partnerships across live sports, entertainment, comedy, and audio, going toe-to-toe with other media platforms like Spotify in the process.

The biggest content creators will be set apart from the rest with their own shows and massive built-in Netflix audiences, threatening Hollywood’s power.

3. Newfronts vs. Upfronts 2025: Traditional brands will look to position themselves as dynamic

While traditional media players like Disney have reigned supreme at Upfronts, that equation has flipped as the landscape becomes more dynamic. Today, networks at the Upfronts are increasingly looking at social’s success with cultural influence and attention, commerce, and performance outcomes–and looking to adapt accordingly.

Platforms like Amazon and Netflix are rolling out more multi-component universes in an attempt to be a part of consumers’ everyday experiences. That could be anything from watching sports to listening to audio to gaming. While legacy players have also touted their offerings, Amazon and Netflix have made waves with their tech-first focus, fast pace of innovation, and original IP (a lot like the playbook that spurred TikTok’s unprecedented growth in recent years).

Yesterday’s narrative of emphasizing sheer reach, products, and inventory isn’t exciting to marketers looking to capture attention in 2025. This year, we’re looking out for new ways networks are positioning themselves as flexible, engaging, and interactive, rather than stuck in an old mindset.

Traditional partners are going to double down on programmatic, self-service, and integrations with major DSPs like DV360 and TTD to become more adaptable and accessible. We don’t think we’ll see anything spectacularly different between the major players; instead, look out for gradients of maturation and who is standing out through unique data use and brand storytelling.

With the continuing collapse of the marketing funnel, more players might shift from Newfront to Upfront presentations (like Hulu has done in the past). There probably won’t be an end to the NewFronts as a whole in the immediate future, but we’re predicting that the events will blend in the next year or two as we see even more cross-pollination across ad offerings and the lines between digital and traditional media continue to blur.

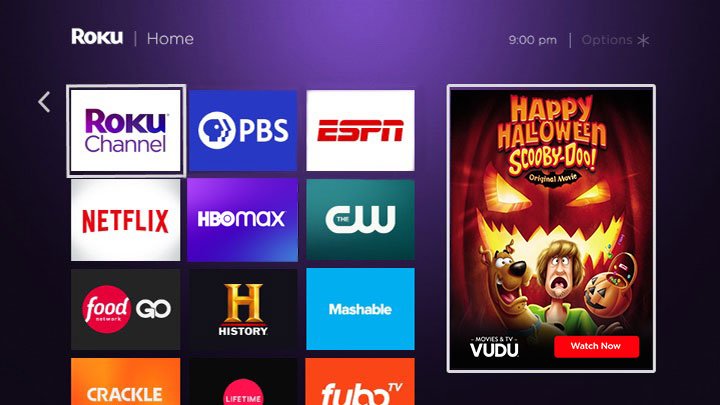

4. There’s a new battlefield in streaming: the homescreen

The platforms that are rising to the top are the ones thinking outside the box–or video player. The homescreen is new territory for advertisers, and we’ll see that reflected in both the Newfronts and Upfronts this year.

Rather than focusing on CTV inventory alone, Roku and Samsung have been honing in on the homescreen, selling access to where attention still has some staying power. The initial few seconds on the homepage is prized territory where brands can get the reach and undivided attention that support big brand moments.

In a world where every minute of TV viewing is more easily commoditized and transactable via major DSPs, this could be a breakthrough moment for Roku, especially with experiential elements like Roku City.

We’re predicting that high-impact, creative, and experiential opportunities for brands will be big differentiators this year, giving Roku, Samsung, and others a competitive edge as advertising becomes more tech-led and uniform overall. Platforms that can bring unique offerings like surfaces, units, and audiences will stand out by giving brands a place to achieve real engagement and growth.

What we want to see: It’s time for Newfronts and Upfronts to come together

The days when there was a stark divide between Newfronts and Upfronts are over. Where once Newfronts represented up-and-coming digital advertising and Upfronts were the bastion of traditional media, the line between the two categories has become much less clear.

Social platforms have made a push for consumer attention, redefining entertainment value and shifting creators into the roles of legacy actors. Bigger streamers, on the other hand, have been trying to become more dynamic, tech-led, and exciting.

As both sides work to push into the other’s lane, their target audiences and the advertisers they’re competing for at the Newfronts and Upfronts have effectively converged. So why are we still treating them differently?

We’re ready for marketers to knock down the wall between Upfronts and Newfronts. Media is converging, and it’s time to start looking at it holistically, rather than clinging to the categories of yesteryear.