Every part of the marketing industry has been disrupted in the last five years. All of those changes, from macro factors like the pandemic and economic uncertainty to powerful industry forces like data deprecation and AI, have impacted the cost of media.

But how are media costs changing?

We dug into the data and consulted our experts to figure out what the future of media costs will look like and how that should impact your budget planning in the future.

Setting the stage: the state of marketing budgets

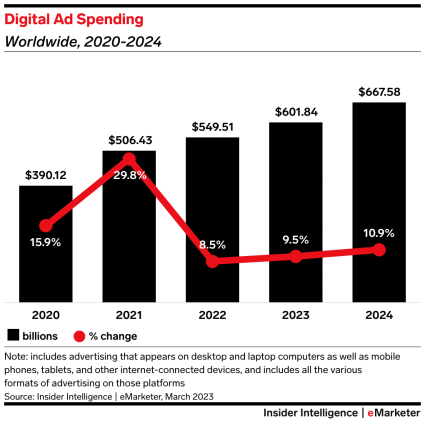

Most marketers feel like they have don’t have enough budget, but the real numbers tell a more nuanced story. Even with brief retractions due to the economic turbulence that hit the market from mid-2022 into 2023, overall ad spend is still forecasted to rebound in 2024, especially AVOD/CTV.

Source: eMarketer

Digital ad spend is projected to stay relatively flat from 2023 to 2024 after the massive gains during the pandemic. In response competition is rising across traditional top performers like search and social, as well as fast-growing channels like CTV and retail media that are capturing more dollars than ever before.

Digital advertising has now reached a new level of maturity as an industry, and that means there are some new opportunities for savvy marketers to take advantage of. But it also means it’s a tricky time to evaluate media costs and predict the best places to splurge on media and where to cut back to get the best bang for your buck.

If these media headwinds have had you looking for a sign, there are two trends you need to be aware of as you evaluate your ad spend in the future.

Trend #1: Premium placements make a big impact—but the price tag is high

One of the most exciting (and pricey) trends in media spending today is the rising demand for ads in premium environments.

These ultra-rich options promise top-shelf placements and more brand safety, but they come at a high cost because of the level of competition. And if brands layer additional targeting or data requirements on top of these buys, the price gets even higher.

This hasn’t stopped most brands from investing in these placements, especially on streaming and digital video. A new report from Comcast Advertising found that 94% of advertisers will maintain or increase their premium streaming investment despite economic uncertainties.

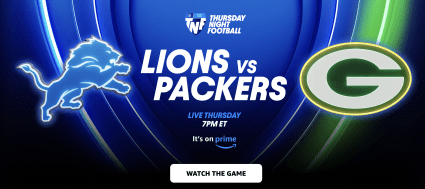

That’s because the audience is there: the rate of premium programmatic ad views has increased by 12% YoY, owing much of that increase to many live sports moving to streaming platforms in 2023.

Source: Amazon Prime

The cost of these premium placements will only continue to rise in 2024 and beyond as competition increases. We’ll also see brands that are already skittish about the volatile political environment leaning into these safer placements as we face another election year, driving prices up further.

Retail media networks (RMNs) partnering with both streaming services and social media platforms are also likely to impact costs. RMNs are leveraging their valuable first-party data across the advertising ecosystem, opening up more privacy-compliant targeting capabilities. New potential premium activations on CTV, including AI-powered product placement, could also increase prices.

These high-value ads are appealing for a reason. Premium environments like live sports events let you reach a wide audience without worrying about your brand being associated with anything that might turn customers off–something that happens all too often in more volatile online placements.

But you have to consider how to balance the benefits with the cost. If you lean into premium placements, you’ll be getting fewer ads for your dollars, but the impact and brand safety may be worth the price.

Trend #2: AI-scaled ad placements come with bigger risks but promise more efficiency

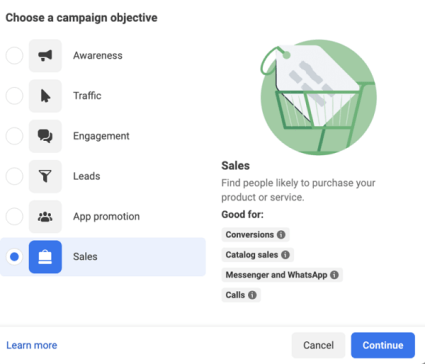

The expanding field of AI-scaled placements lets advertisers place lots of ads while spending less. They’re an exciting option for brands looking to drive down costs, but they also come with downsides: you’ll have less control over your ads and the context in which they’re appearing on both the open web and on various platforms like Google (Performance Max, or PMax) and Meta (Advantage+, or ASC).

These new ad types offer new opportunities to claw back and maximize efficiencies on digital channels with these new tools, particularly as more automation-powered ad types show up in the market and the offerings get more mature. We’ve already seen both PMax and ASC delivering some impressive returns.

Meta in particular has shown big gains recently thanks to its AI-scaled efforts, forecasting Q3 2023 revenue of $32-34.5 billion and surpassing analysts’ $31 billion expectation. That’s largely due to the success of the platform’s so-called “year of efficiency,” which opened up more ad space at lower cost across its portfolio of products for the second quarter in a row. In the second quarter of 2023, Meta’s ad impressions increased by 34% YoY while the average price per ad decreased by 16% YoY.

Advantage+ has been a big driver of Meta’s earnings. According to Meta’s internal data, Advantage+ shopping campaigns deliver an average of 32% increased ROAS, while its app campaigns drive an average of 9% improved cost per action.

Source: Meta

Google has seen similar success with its AI-powered PMax offering. Google reports that PMax campaigns drive 18% more conversions at a similar cost per action than traditional ad types.

Suffice it to say, you should be experimenting with AI-scaled ads. But as you set your media mix, you’ll need figure out the right balance of high-priced premium placements and efficiency-driving AI-powered campaigns for your business. Remember: more efficiency means lower prices AND less control.

Balancing priorities to build the best possible 2024-2026 media strategy

Every brand will have a different answer to this essential risk-benefit analysis.

Start by establishing your North Star: what are you trying to accomplish with your marketing? What are the core business objectives you’re working toward? Then evaluate the potential reach, frequency, and penetration of different campaigns. You also need to factor in the media supply chain and the ultimate value these campaigns can deliver for your business, or you’ll risk missing the forest for the trees.

While it’s tempting to go for scale to help keep efficiency under control, consider what exactly you’re paying for and whether it’s worth it to your business. Ask some tough questions: is efficiency the real end game? Are higher CPMs necessarily a bad thing if those placements are successfully converting high lifetime value customers?

The course is clear: find the right mix of higher value, expensive premium activations and scaleable, cost-saving AI-powered campaigns that aligns with both your audience and your business objectives.

Over the next two years, the most successful brands will surge ahead of the competition by building well-balanced yet agile strategies, willing to pay more for certain placements that will get them in front of higher-value audiences while taking advantage of efficient media. They’ll also build continuous testing into their budgeting and overall approach so they can take advantage of new opportunities and readjust tactics and the media mix to drive better performance and keep costs under control.

Responses