Picture this: you’re at the end of a long meeting about company OKRs. Your CFO is talking about profitability and where to cut costs–and your marketing budget is the first thing on the chopping block.

Telling them about your ROAS isn’t going to convince a finance team looking for hard numbers–or at least the numbers that matter to them–to shift budget your way. Instead, you need to break out your Rosetta Stone and speak their language.

To prove their value (and, more to the point, get or defend budget), marketers need to make the case to finance and other executives that marketing is a growth driver, not just an expense. That means bridging the gap between finance and marketing.

That can be a major challenge when marketers and finance departments think differently about goals and results. But if you can provide evidence of measurable business impact that satisfies both departments’ needs and forge an alliance between these teams, you can get the funding and respect you need to maximize your brand’s growth.

Translating success: connecting marketing metrics to business results

It’s hard for marketing and finance to see eye to eye when they’re looking at totally different sets of metrics. As you know, finance focuses on overall business results like sales and earnings, while marketers tend to zero in on ROAS, channel-specific results, and campaign performance. Too many assume that finance will automatically understand how those KPIs impact the business as a whole.

Marketing goals often ladder up to acquisition and retention, whereas finance is ultimately held accountable for what’s on a company’s financial statements. Translation: profitability, risk, and costs. If your departments talk past each other, it’ll only result in mistrust and missed opportunities on both sides.

Fast friends: forging an alliance with finance

Here’s how you can get on the same page:

Exchange buzzwords for business terms

You can make major strides in your collaboration with finance just by defining your terms in the right language. Think about it this way: you need to market the value of your work to finance by speaking their language, just like you do with your customers. Aligning your offering with how you help the finance team overcome their own challenges or achieve their goals is critical.

If you’re looking for a quick win, start by turning marketing speak into legible financial priorities. Try:

- Replacing vanity and tactical metrics with business impact measures

- Framing requests in terms of revenue, cost savings, and risk mitigation

- Acknowledging what marketing can and cannot control when it comes to overall results

Align on KPIs that make sense to both departments

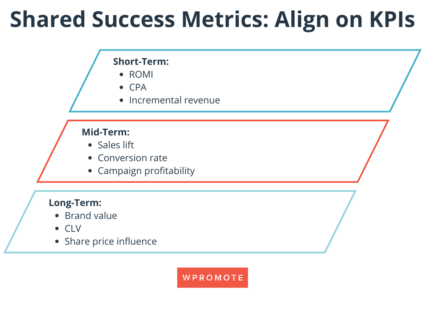

Involve finance early on in campaign planning, rather than bringing them in at the end, when measurement has already been set. That way, you can align on expectations and success metrics for short-, mid-, and long-term business impact.

Key Insight: Don’t emphasize marketing ROI alone. While it can seem like a great metric to quantify results, relying solely on ROI limits marketing’s perceived value. It doesn’t capture the full scope of marketing’s contribution to broader enterprise goals like market share, profitability, and sustainability. CMOs should instead embrace return on objectives (ROO)–which evaluates how well an initiative meets its specific, predefined objectives, rather than focusing only on direct financial returns–to demonstrate how marketing supports a wider array of business outcomes.

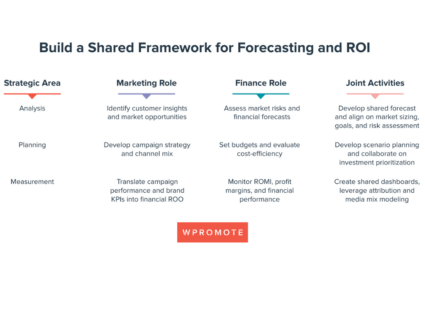

Define roles and opportunities for collaboration

To partner effectively with finance in the long term, you’ll also need to build a shared process clearly outlining how your teams can work together.

You can’t do that alone; you have to get on the same page with all the internal stakeholders who need to understand how marketing can help achieve profitability and the resources you need to make that impact. That means you need to be educating and evangelizing the role marketing will play with executives, finance, and other leaders.

To do this, you should leverage cross-functional tactics, including:

- Developing hybrid roles to bridge marketing and finance

- Using cost-benefit analyses and attribution models

- Incorporating finance-friendly tools such as media mix modeling (MMM) to connect marketing to overall business impact

Kicking off a strong relationship with finance

When your team is starting a new partnership, it’s a good idea to take the time to assess what you’re doing right now and what you can improve.

Assess current metrics with a new analysis:

- Use regression analyses to uncover cause-and-effect relationships between metrics and financial success. These can help you challenge assumptions about some metrics and prove the financial value of others.

- Stack rank each metric to evaluate the statistical relationship between the customer action and outputs that impact financial performance.

- Pay attention to dependencies and handoffs between different phases of the customer journey. That way, you can optimize based on metrics that actually result in the bottom-line impact finance is looking for.

Once you’ve considered your current tactics, it’s time to start testing new ways of measuring and collaborating. Start small so you can figure out what works before committing to larger-scale efforts.

Build trust with a pilot program:

- Select a direct-response marketing program with easy-to-track data points, a control group, and metrics for marketing success (like sales conversion), along with financial impact (like the program’s effect on revenue or profitability).

- Create a shared dashboard that includes financial impact metrics and use the results of this pilot to build the business case for marketing and finance collaboration.

- You can use this collaborative measurement strategy for future direct-response marketing programs. Start developing a similar strategy for harder-to-measure brand-based campaigns.

Once you’ve put your new measurement strategy to the test, your team can consider what worked and what you’d like to implement in the future to make the process even smoother.

Building a bridge between marketing and finance won’t be easy, but it will be worth it in the long run: You can’t get that all-important budget if the people holding the purse strings don’t understand the impact of marketing on the bottom line. When both departments are aligned on the metrics that matter, your team can get what your marketing needs to succeed.

Responses