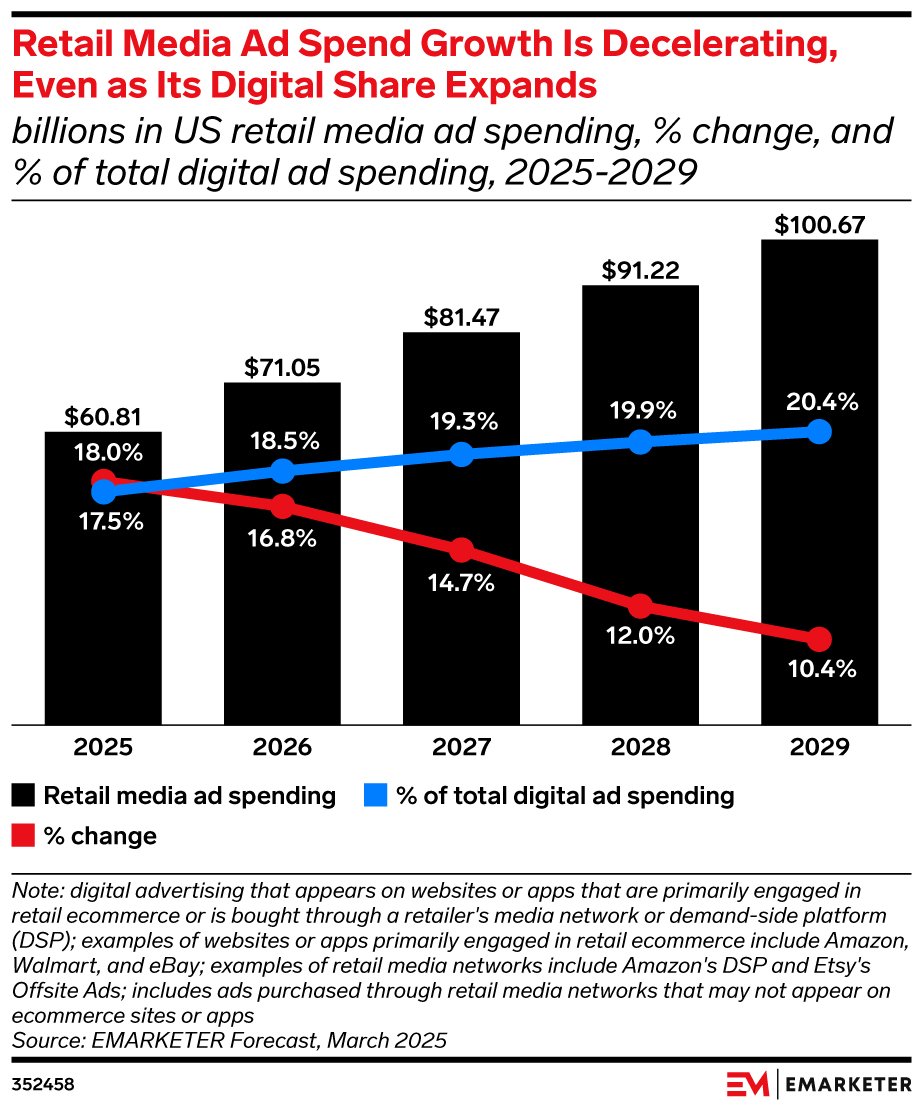

It’s not news that retail media networks (RMNs) have become a major force in digital advertising. In recent years, they’ve peeled away ad dollars from more familiar digital marketing channels and taken over a major share of the market; eMarketer projects that retail media will represent more than $1 of every $5 spent on digital media by 2029.

Today, new partnerships between RMNs and entertainment platforms offer expanding opportunities for marketers looking to reach large audiences with the hallmark benefits of retail media.

A big part of retail media’s value is in its abundant first-party shopper data, which can help advertisers target audiences effectively even amid data privacy changes. But RMNs have an Achilles heel: many of them lack reach, particularly in the upper funnel.

That’s where entertainment platforms come in. CTV, streaming, and digital video pull massive audiences–but they could benefit from more precise targeting and the ability to tie ad exposure to real-world buying behavior.

Integrating RMNs and entertainment platforms might just offer marketers the holy grail: data and reach coming together to drive the strongest consideration and purchase behavior, with stronger attribution to boot.

We’re breaking down how retail media and entertainment partnerships fit into the new buyer journey, how these relationships drive purchases, and key integrations your brand should be testing today.

Retail media, media convergence, and the new buying journey

If the old way of making a purchase decision was a straightforward path, the new customer journey looks more like a game of chutes and ladders: a customer can now jump from discovery to purchase with a single click or slide back down to consideration from the brink of checking out because they see a dupe go viral on social media.

The lines between “channels” have never been more blurred. Today, people are searching for and discovering new brands from influencers, watching TV via Amazon, and buying viral items on social media. Platforms are competing on all fronts for consumer attention and brand dollars, and they need to provide an engaging experience even as user preferences evolve and ensure brands can generate a return on their investments despite data deprecation.

Retail media networks like Amazon, Walmart, and Target make up a big slice of the conversation around convergence. These networks offer some enticing benefits to brands, especially access to their vast troves of first-party data to help fill the data void left behind by multiplying privacy regulations–and now, scaled reach and novel adtech capabilities. Marketers will also be able to get more granular as inventory opens up, thanks to platforms like Amazon and Walmart Connect moving fast to innovate and bring new capabilities to market.

Amazon, in particular, has expanded its non-endemic offerings in the last few years, strengthening its value proposition for advertisers that don’t sell on the site, and made moves to enhance its third-party supply inventory and grow its reach.

Retail media takes over new spaces through partnerships

Retail media isn’t just expanding; it’s entering spaces that haven’t supported this kind of targeting before. That opens up new ways to evaluate performance, especially in places that haven’t offered that kind of visibility until now.

An explosion of ‘retail media’ purveyors, plus partnerships between RMNs and cross-channel media platforms, has capitalized on the need to connect data and reach.

But no boom can last forever: retail media ad spending growth is slowing year-over-year (although retail media’s digital share is still on an upward swing overall). As retail media matures, marketers will prioritize their must-have partners based on data, reach, and value added. This process is separating the wheat from the chaff in a crowded space, so only the very best partnerships rise to the top.

Source: eMarketer

Increasingly, those relationships are between RMNs and entertainment platforms.

Retail media and entertainment partnerships are the future

By bringing together the reach of entertainment and the robust shopper data of retail media, partnerships between RMNs and entertainment platforms create a powerful force for targeting, engaging, and converting customers–all while they’re binge-watching must-see TV or catching up with their favorite YouTuber.

CTV is a major bright spot in advertising right now, continuing to gain more ad spend, pulled mostly from declining linear TV budgets. And it’s clear that the concurrent rise of retail media and CTV is no accident; in fact, it’s more like a symbiotic relationship. More and more CTV ad dollars are retail media spend.

But CTV platforms often lack transactional or shopper-specific data. That makes RMN partnerships an especially valuable complement, since they can provide more precise targeting for advertisers.

Meanwhile, RMNs like Amazon and Walmart, which are making a big play for non-endemic brand dollars, need the upper-funnel engine of CTV to deliver on reach. The combined potential of new targeting capabilities and inventory opportunities is tantalizing to advertisers, even if they’re not yet fully mature.

Introducing a new kind of ad

Recent major partnerships have opened up opportunities for marketers to leverage entertainment reach with new types of ads.

NBCUniversal announced a deal with Walmart in June that allows brands to target viewers using verified purchase behavior by bringing Walmart Connect’s shopper data into live sports ads. The rollout expanded Walmart’s retail media reach into premium TV environments and tied commerce signals to live sports placements for the first time.

In another groundbreaking move, Roku and Amazon launched a partnership to make Roku’s owned-and-operated inventory, including the Roku Channel, available programmatically through Amazon DSP. The deal allows advertisers to pair Roku’s CTV supply with Amazon’s first-party shopping and streaming data to support more advanced audience targeting.

Source: The Hollywood Reporter

A CTV shopping example: Roku meets the Walmart checkout aisle

To break down how these advertising relationships function, let’s look at an example.

As a consumer is watching TV (or, almost as time-consuming, looking for a show to watch), a shoppable ad appears on the Roku Channel during a commercial break or a shoppable Marquee ad shows up on the Roku home screen. If they’re interested, they can hit “OK” on their Roku remote to access the ad.

For a single-item ad, Walmart item information pops up for that product; while for a multiple-item ad, a product carousel opens. For single-item ads, the customer can just click “Proceed” to checkout. For multiple-item ads, the customer can choose to click checkout on TV, shop on phone, or link their Walmart account to make a purchase.

If they check out on their TV, Roku prepopulates customer details, the customer clicks “Place Order,” and Walmart processes the order as a guest checkout. Then, presto: like magic, Walmart’s purchase confirmation appears on screen, and the customer receives an email with shipping, return, and support information.

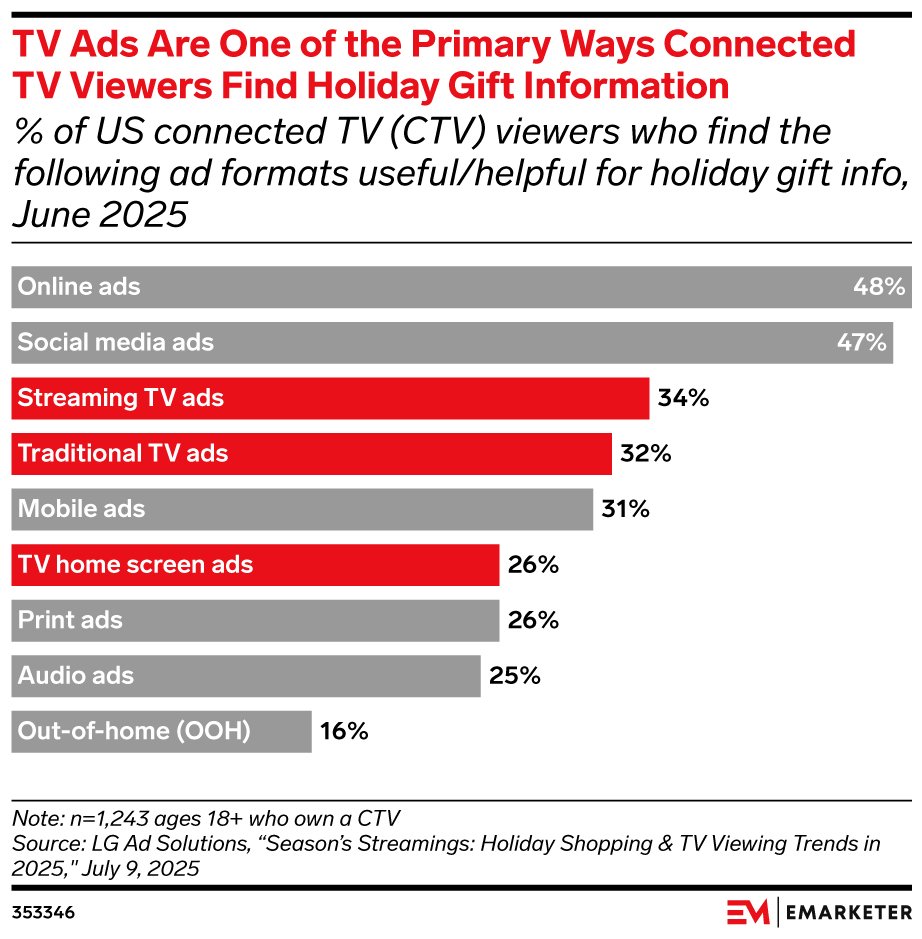

This fast, almost frictionless buying journey is the pinnacle of combining CTV and streaming with retail media. It’s no surprise that CTV ads are gaining share; according to an LG Ad Solutions survey, 59% of users say CTV ads help guide holiday purchases (up 43% YoY), while 26% of shoppers find CTV home screen ads helpful for purchases (up 105% YoY).

Source: eMarketer

Next steps: key retail media-entertainment integrations to consider

So how can your brand tap into the retail-meets-entertainment movement?

With the ecosystem evolving this fast, you need to keep your finger on the pulse when it comes to new RMN-media partnerships and which platforms are showing the strongest results.

You can start testing key opportunities right now to see what works for your brand, including:

- Non-endemic offerings like those on Amazon

- Retail targeting with functionalities like The Trade Desk’s large library of retail data segments based on direct partnerships with major retailers like Walmart, CVS, Albertsons, and more

- Shoppable ad units from players like:

- Amazon: Prime Video supports clickable ads that lead to product pages or Amazon storefronts

- Disney/Hulu: Provides interactive ads with direct-to-checkout options

- Google: YouTube offers shoppable video ads and live streams with creator and affiliate components

There will be many more evolutions to test as the landscape continues to change, especially with entertainment now starting to encompass social platforms, too. The bottom line: the brands that win in the future will be the ones prepared to take the new world of retail media into account and tailor their consumer, media, and measurement approaches to that changing reality.

Responses