Thanks to high savings account interest rates, fewer fees, and the ability to make convenient transactions, online-only banks have been quickly gaining popularity. Not only are people are switching to these direct banks, but research shows they are happy with their experiences.

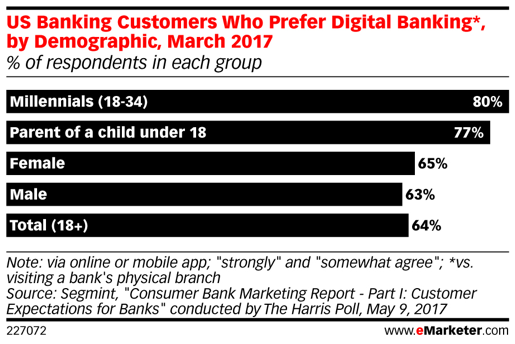

A J.D. Power study found online-only “branchless” banks received higher satisfaction scores than traditional branch-based banks. eMarketer published results of a Harris Poll which found that 80% of millennials and 77% of parents of a child under age 18 preferred digital banking vs. visiting a bank’s physical branch.

There’s no doubt that online-only banks are becoming more of a threat to traditional financial institutions. So how can brick-and-mortar banks grow in this increasingly competitive space? They need to up their games when it comes to the online customer experience. Here are some things traditional banks should be focusing on right now to reach and engage their target markets:

Ensure The Website Is Mobile-Friendly

It is imperative for a traditional bank to have a mobile-friendly website. People are researching and comparing financial products, interest rates, and services from their smartphones and tablets. They are conducting transactions 24/7. If they can’t do what they want or find what they need on a bank’s website in an efficient manner, they will leave. In fact, market research conducted by Allied Market Research found that customer convenience, i.e. the ability to make transactions quickly and easily through mobile devices, was one major factor driving consumers to online banks.

A poor mobile user experience can also dramatically affect how people perceive a business. A study cited by Experience Dynamics found that “52% of users said that a bad experience made them less likely to engage with a company” and 48% of users said, “they feel frustrated and annoyed when on sites that are poorly optimized for mobile.” A bank’s website needs to provide customers and prospects with a seamless experience no matter what device is being used to access it.

Enhance The Local Search Presence

People who are searching for a bank in a specific location are actively looking for a traditional bank. To capture these searchers, it is important for a bank to be found in the local pack results, as well as organic results for geotargeted keywords. With nearly half of all U.S. searches including local intent, bank branches can’t afford to miss out on these users.

Create Focused Content

A traditional bank’s website should feature quality content about all the products and services it offers; however, special attention should be focused on the products and services not typically offered by online-only banks.

Brick-and-mortar banks may not be able to tout the highest savings interest rates or lowest fees, but they frequently offer a wide range of lending and investment options, as well as face-to-face customer service and financial planning services. By creating and/or expanding product and customer service pages, blog articles, online financial resources, videos, and other valuable content, a traditional bank can showcase its unique offerings, dedication to personal service, and leadership in the industry.

We may live in a digital world, but people still do value the human element of banking. This is where traditional banks excel.

Consumers like to speak to someone in person about mortgage options and other loans. They want financial advice from an institution they can trust. They seek out professionals who can help them reach their particular financial goals. Content that demonstrates that the bank understands and solves people’s financial concerns can draw in new customers and promote loyalty.

Engage The Community Through Social Media

One significant differentiator between brick-and-mortar banks and direct banks is that the former serves the communities in which they are located. By using social media channels, a bank can foster a sense of community and a personal connection with area residents by sharing content about local event sponsorships, contests, employees, charity activities, etc. Social content should reflect the authentic voice of the bank and can be used to generate leads, build awareness and nurture existing relationships.

Brick-and-mortar banks have quite a few strengths over online-only banks, but these advantages are getting lost amid consumers’ search for the best rates and fewest fees. By allocating time and money to online banking technology, website UX, search engine optimization, and digital marketing, traditional banks will be better able to attract new customers, keep their current ones and maintain and grow their share of the market.

Responses